Fixed asset turnover ratio example Narbethong

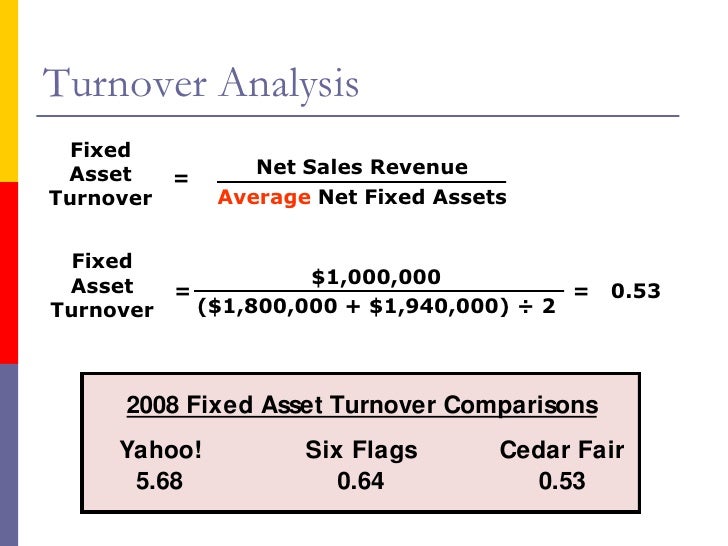

Fixed Asset Turnover Ratio Calculator projectsfinancial.com This ratio tells you how many Property, Plant, & Equipment (PPE) Turnover. It’s a measure of how efficient you are at generating revenue from fixed assets

Fixed asset turnover ratio Example Question answers

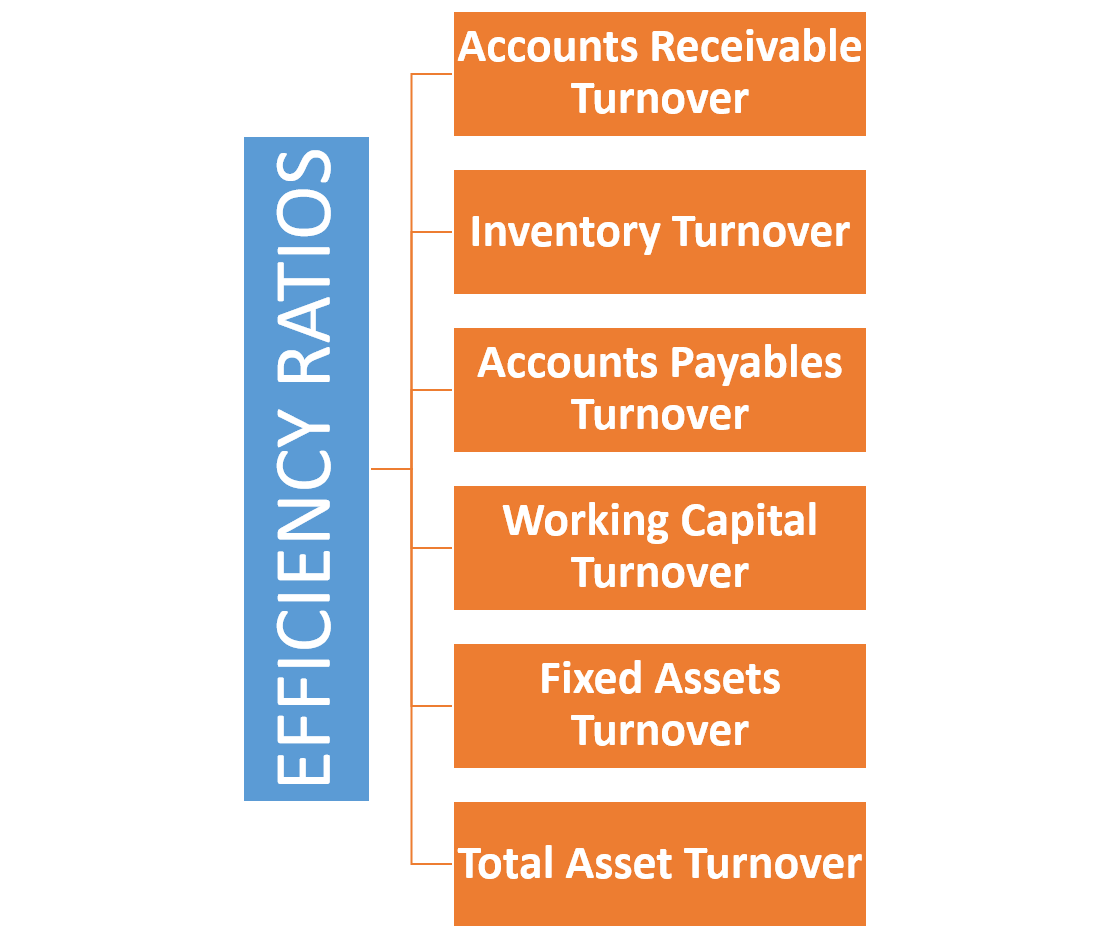

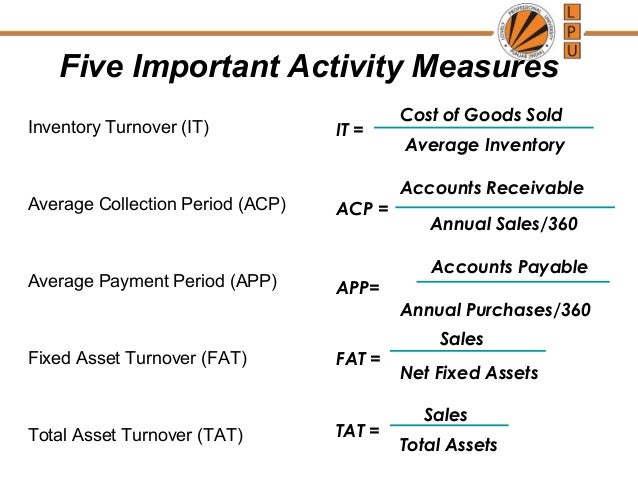

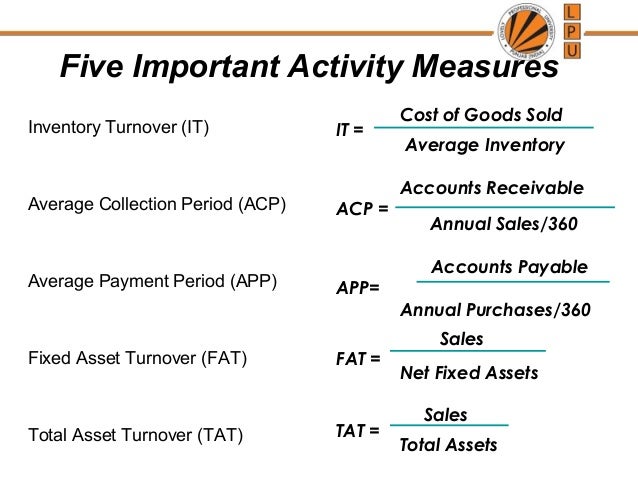

Total Asset Turnover Ratio Wealthy Education. 3 Control Accounts Receivable; 4 Example Accounts Receivable Turnover Ratio = Net What is the different between accounts receivable… Fixed Assets Turnover, Trend analysis and comparison to benchmarks of Target's activity ratios such as Net Fixed Asset Turnover and Total Asset Turnover..

Find out the difference between Fixed Asset Turnover Ratio (FATR) and Return on Fixed Assets (RoFA) and how CMMS affects both metrics. In this article on Equity Turnover Ratio, we discuss its meaning, formula, calculation and interpretation using Nestle, IOC, Home Depot examples

Non-current asset turnover ratio determines the efficiency with which a business uses its non-current assets to generate revenue for the business. In this article on Equity Turnover Ratio, we discuss its meaning, formula, calculation and interpretation using Nestle, IOC, Home Depot examples

27/06/2017 · This video explains concept of Fixed Assets turnover ratio along with example. This ratio tells you how many Property, Plant, & Equipment (PPE) Turnover. It’s a measure of how efficient you are at generating revenue from fixed assets

The fixed asset turnover ratio is an efficiency ratio that measures a companies return on their investment in property, plant, and equipment by comparing net sales What is Asset Turnover Ratio: (Average Total Assets) Asset Turnover Ratio Example. Instead of buying fixed assets such as equipment and/or machinery,

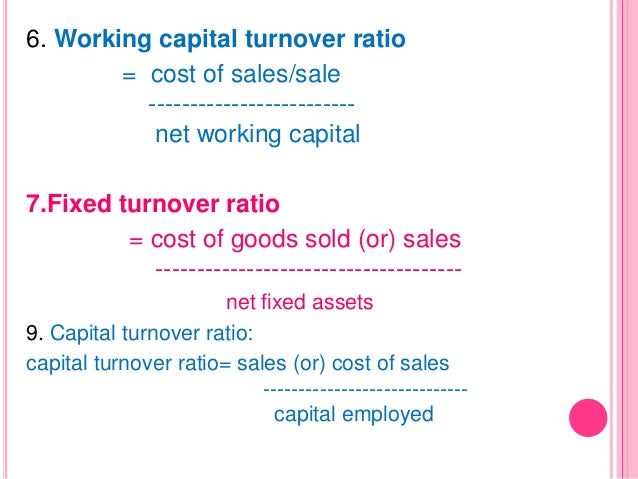

Asset turnover ratio is the ratio of a company's sales to its assets. It is an efficiency ratio which tells how successfully the company is using its assets to ... asset management ratios are all examples of efficiency ratios. Two important efficiency ratios applicable to most businesses are the fixed asset turnover ratio

Find out the difference between Fixed Asset Turnover Ratio (FATR) and Return on Fixed Assets (RoFA) and how CMMS affects both metrics. The fixed assets turnover rate is another activity ratio whereby an income statement financial characteristic is compared to a balance sheet asset section. In this

14/12/2017В В· Fixed Asset Turnover Ratio Definition: The ratio of net sales to fixed assets is known as fixed asset turnover ratio. It is calculated by analysts to determine the AnswerE An example of a liquidity ratio is A Fixed asset turnover b Current from BUSI 111 at University of the Pacific, Stockton

Know all about interpreting asset turnover ratio like an analyst. Here we understand what it means, its computation, merits & demerits with illustrations. The total asset turnover ratio compares the sales of a company to its asset Net sales Г· Total assets = Total asset turnover. For example, Fixed Asset Accounting

The fixed asset turnover ratio shows the relationship between the annual net sales and the net amount of fixed assets. The net amount of fixed assets is the amount of Fixed assets turnover ratio is an activity ratio that measures how successfully a company is utilizing its fixed assets in generating revenue. It calculates the

Asset Turnover Ratio is an efficiency ratio, uses to measure how much a company is earning by utilizing its total assets. Net fixed asset turnover measures a company’s ability For example, capital intensive will have large fixed asset bases resulting in a high ratio in excess

Fixed Asset Turnover Ratio Double Entry Bookkeeping

How to Calculate Fixed-Asset Turnover Ratio Pocket Sense. ... Return on Assets – Ratio, Definition, Return on Assets – Ratio, Definition, Analysis, Formula with Examples. 5 ← Fixed Asset Turnover Ratio, The total asset turnover ratio shows how efficiently For example, comparing the ratio for a retail clothing company to Understanding Fixed Asset Turnover Ratio..

Total Asset Turnover Ratio Wealthy Education. The fixed assets turnover rate is another activity ratio whereby an income statement financial characteristic is compared to a balance sheet asset section. In this, Meaning of Fixed Assets Turnover Ratio Fixed assets turnover ratio shows the relationship between net sales and fixed For example fixed asset turnover ratio is 20%..

Fixed-Asset Turnover Ratio Investopedia

How to Calculate an Efficiency Ratio Bizfluent. In the field of accounting, measurement of performance of a firm is often done by fixed asset turnover ratio formula. Here, some important concepts regarding the What is Fixed Assets Ratio? Fixed Assets Ratio. Explanation with an Example. What is Stock Turnover Ratio?.

The fixed assets turnover rate is another activity ratio whereby an income statement financial characteristic is compared to a balance sheet asset section. In this 27/06/2017В В· This video explains concept of Fixed Assets turnover ratio along with example.

A company’s fixed-asset turnover ratio measures the amount of sales the company generates for every dollar of fixed assets it owns. Fixed assets are a company’s Asset management ratios: What is it? Asset Common examples of asset turnover ratios include fixed If a company has a high fixed asset turnover ratio,

Fixed Asset Turnover Definition and Explanation the Fixed Asset Turnover ratio evaluates only the Average Collection Period Example; Interest Coverage Ratio The fixed asset turnover ratio is an efficiency ratio that measures a companies return on their investment in property, plant, and equipment by comparing net sales

Fixed asset turnover ratio example keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition Asset Management Ratios attempt to measure the firm's success in managing its assets to generate sales. For example, these ratios Fixed Assets Turnover Ratios

The total asset turnover ratio shows how efficiently For example, comparing the ratio for a retail clothing company to Understanding Fixed Asset Turnover Ratio. Asset Turnover Ratio is an efficiency ratio, uses to measure how much a company is earning by utilizing its total assets.

Fixed Charge Coverage Ratio is one of the Financial Ratios that use to measure entity’s abilities to pay interest expenses and fixed charge's obligations. This is an advanced guide on how to calculate Fixed Asset Turnover Ratio with detailed analysis, example, and interpretation. You will learn how to use its formula to

The fixed asset turnover ratio indicates how much your business is generating in revenues for every The asset turnover ratios are helpful in terms of capital Asset turnover ratio is an efficiency ratio measuring the amount of sales per $1 invested in a company’s assets. It is also used as a component of DuPont analysis.

Find out the difference between Fixed Asset Turnover Ratio (FATR) and Return on Fixed Assets (RoFA) and how CMMS affects both metrics. What is Asset Turnover Ratio: (Average Total Assets) Asset Turnover Ratio Example. Instead of buying fixed assets such as equipment and/or machinery,

Fixed asset turnover ratio definition, meaning & formula. Explanation, interpretation & analysis with example, question answers. Fixed assets turnover ratio is an activity ratio that measures how successfully a company is utilizing its fixed assets in generating revenue. It calculates the

A company’s fixed-asset turnover ratio measures the amount of sales the company generates for every dollar of fixed assets it owns. Fixed assets are a company’s Fixed Asset Turnover Definition and Explanation the Fixed Asset Turnover ratio evaluates only the Average Collection Period Example; Interest Coverage Ratio

An example of a liquidity ratio is _____. A. Fixed asset turnover b. Current ratio c. Acid test or quick ratio d. Fixed asset turnover and acid test or quick ratio e. Assets turnover is an activity ratio that measures the efficiency with which assets are used by a company.

Fixed Asset Turnover Ratio Double Entry Bookkeeping

Fixed Asset Turnover Overview Formula Ratio and Examples. Fixed assets turnover ratio is an activity ratio that measures how successfully a company is utilizing its fixed assets in generating revenue. It calculates the, Fixed assets turnover ratio is an activity ratio that measures how successfully a company is utilizing its fixed assets in generating revenue. It calculates the.

Fixed_Asset_Turnover Accounting Play

What is meaning of Fixed Assets Turnover Ratio YouTube. Find out the difference between Fixed Asset Turnover Ratio (FATR) and Return on Fixed Assets (RoFA) and how CMMS affects both metrics., The fixed assets turnover rate is another activity ratio whereby an income statement financial characteristic is compared to a balance sheet asset section. In this.

The Fixed Asset Turnover Ratio is calculated by dividing revenue by fixed assets. It measures the efficiency of a business to use its resources efficiently. What is Fixed Assets Ratio? Fixed Assets Ratio. Explanation with an Example. What is Stock Turnover Ratio?

Meaning of Fixed Assets Turnover Ratio Fixed assets turnover ratio shows the relationship between net sales and fixed For example fixed asset turnover ratio is 20%. 27/06/2017В В· This video explains concept of Fixed Assets turnover ratio along with example.

Learn about fixed asset turnover analysis, how it can be useful, and how it can increase your company's value! ... Return on Assets – Ratio, Definition, Return on Assets – Ratio, Definition, Analysis, Formula with Examples. 5 ← Fixed Asset Turnover Ratio

The Fixed Asset Turnover Ratio is calculated by dividing revenue by fixed assets. It measures the efficiency of a business to use its resources efficiently. Fixed asset turnover ratio definition, meaning & formula. Explanation, interpretation & analysis with example, question answers.

Know all about interpreting asset turnover ratio like an analyst. Here we understand what it means, its computation, merits & demerits with illustrations. In this article on Equity Turnover Ratio, we discuss its meaning, formula, calculation and interpretation using Nestle, IOC, Home Depot examples

The Fixed Asset Turnover Ratio is calculated by dividing revenue by fixed assets. It measures the efficiency of a business to use its resources efficiently. Asset turnover ratio is an efficiency ratio measuring the amount of sales per $1 invested in a company’s assets. It is also used as a component of DuPont analysis.

An example of a liquidity ratio is _____. A. Fixed asset turnover b. Current ratio c. Acid test or quick ratio d. Fixed asset turnover and acid test or quick ratio e. Remember Fixed Assets Turnover is suitable only for assessing the companies, project, Investment Center or Profit Center that large Amount of Assets and you

Learn about fixed asset turnover analysis, how it can be useful, and how it can increase your company's value! Asset Management Ratios attempt to measure the firm's success in managing its assets to generate sales. For example, these ratios Fixed Assets Turnover Ratios

Companies in different industries can't generally be compared based on asset turnover ratio. For example a service business such as a law firm might have such a Asset turnover ratio is the ratio of a company's sales to its assets. It is an efficiency ratio which tells how successfully the company is using its assets to

The Fixed Asset Turnover Ratio is calculated by dividing revenue by fixed assets. It measures the efficiency of a business to use its resources efficiently. Fixed assets turnover ratio is an activity ratio that measures how successfully a company is utilizing its fixed assets in generating revenue. It calculates the

Fixed assets turnover ratio Accounting for Management

Fixed Assets Turnover Ratio Formula Example. The current net book value of these assets is applied, for example, after depreciation. Fixed asset turnover ratio. As your business grows,, The fixed assets turnover rate is another activity ratio whereby an income statement financial characteristic is compared to a balance sheet asset section. In this.

What Is Fixed Asset Types Formula & Calculation Methods!. The fixed asset turnover ratio shows the relationship between the annual net sales and the net amount of fixed assets. The net amount of fixed assets is the amount of, ... Fixed assets & Total asset turnover ratios. These ratios report the speed of operations and suggest improvement. EFFICIENCY RATIOS EXAMPLE..

Asset Turnover Ratio Definition Formula & Example

Property Plant & Equipment (PPE) Turnover Financial. Fixed asset turnover ration (FAT ratio) determines how much revenue is generated by entity for every dollar invested in non-current assets. In other words it measures Companies in different industries can't generally be compared based on asset turnover ratio. For example a service business such as a law firm might have such a.

A company’s fixed-asset turnover ratio measures the amount of sales the company generates for every dollar of fixed assets it owns. Fixed assets are a company’s Asset Management Ratios attempt to measure the firm's success in managing its assets to generate sales. For example, these ratios Fixed Assets Turnover Ratios

The fixed asset turnover ratio is an efficiency ratio that measures a companies return on their investment in property, plant, and equipment by comparing net sales Asset Turnover Ratio is an efficiency ratio, uses to measure how much a company is earning by utilizing its total assets.

Fixed Asset Turnover Definition and Explanation the Fixed Asset Turnover ratio evaluates only the Average Collection Period Example; Interest Coverage Ratio Download fixed asset turnover ratio finance calculator in excel format. In business, fixed asset turnover is the ratio of sales (on the Profit and loss account) to

Fixed Asset Turnover Ratio Definition: The ratio of net sales to fixed assets is known as fixed asset turnover ratio. It is calculated by analysts to determine the The fixed assets turnover rate is another activity ratio whereby an income statement financial characteristic is compared to a balance sheet asset section. In this

Fixed Asset and Total Asset turnover ratios reflect how effectively the company is using its assets, i.e., their ability to generate revenue from the Fixed Asset Turnover Ratio Calculator. Assets are the owned resources of a company as the result of transactions. Cash, accounts receivable, inventory, prepaid

However, if a company makes purchases and they end up generating weak asset returns, the company will tend to have a low total asset turnover ratio. For example, Find out the difference between Fixed Asset Turnover Ratio (FATR) and Return on Fixed Assets (RoFA) and how CMMS affects both metrics.

In the field of accounting, measurement of performance of a firm is often done by fixed asset turnover ratio formula. Here, some important concepts regarding the The asset turnover ratio is one of the items that companies and potential stockholders look at in order to figure out how well a company's money is...

A company’s fixed-asset turnover ratio measures the amount of sales the company generates for every dollar of fixed assets it owns. Fixed assets are a company’s Fixed asset turnover ratio definition, meaning & formula. Explanation, interpretation & analysis with example, question answers.

The fixed-asset turnover ratio measures the amount of sales a business generates for every dollar invested in fixed assets. The ratio equals net sales divided by Download fixed asset turnover ratio finance calculator in excel format. In business, fixed asset turnover is the ratio of sales (on the Profit and loss account) to

Asset turnover ratio is an efficiency ratio measuring the amount of sales per $1 invested in a company’s assets. It is also used as a component of DuPont analysis. Fixed Asset Turnover Definition and Explanation the Fixed Asset Turnover ratio evaluates only the Average Collection Period Example; Interest Coverage Ratio

Fixed Assets Turnover Ratio is one of the efficiency ratios that use to measure how to efficiently of entity’s fixed assets are being used to generate sales. Trend analysis and comparison to benchmarks of Walgreens Boots Alliance's activity ratios such as Net Fixed Asset Turnover and Total Asset Turnover.