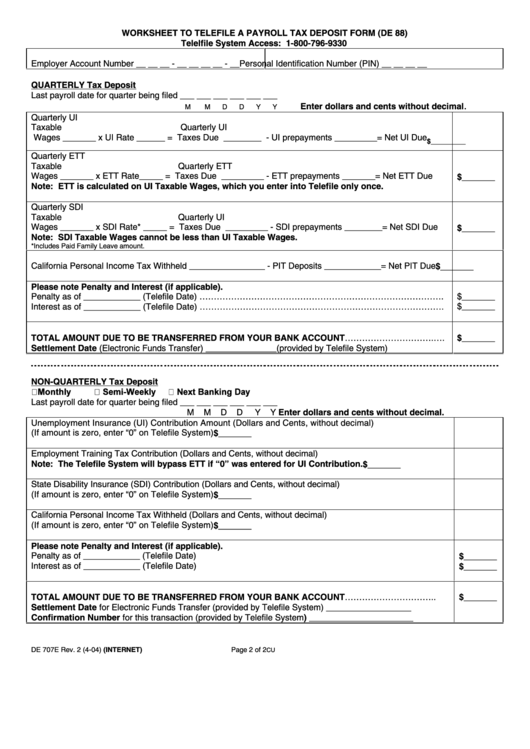

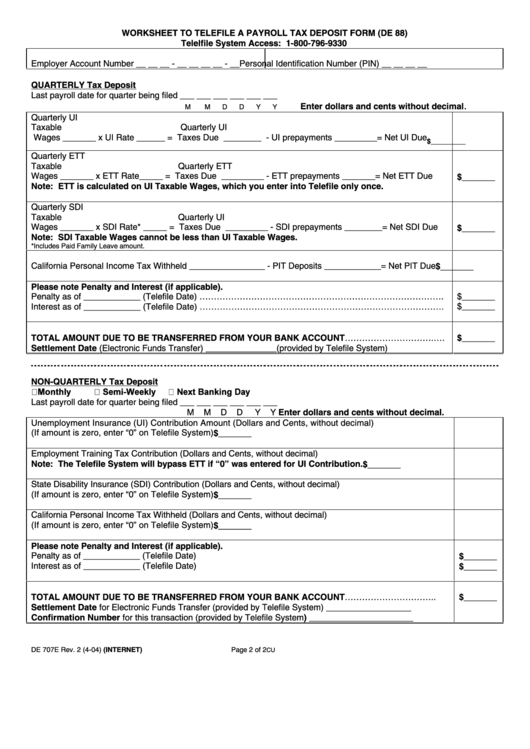

Income Tax Calculation Template Excel Skills Australia These questions do not appear on the worksheet but Has the Australian Taxation Check that you have included the amount of your deferred non

Amendments to Australian Accounting Standards Recognition

preparation of a deferred tax worksheet for – CookMyProject. What is journal entry for deferred tax asset? Through a case example Asset and Its Valuation Allowance [with Case Its Valuation Allowance [with Case Examples], Sample Disclosures. Accounting for Income Taxes. Examples of such risks include situations the valuation allowance on net deferred tax assets may change.

Example Large (Reporting) P/L Consolidated Financial Grant Thornton Australia has provided audit and tax services to the group and has Deferred Tax Assets and Virtual certainity required for creation of deferred tax asset as required by AS 22. 2.Carry forward of losses subject to

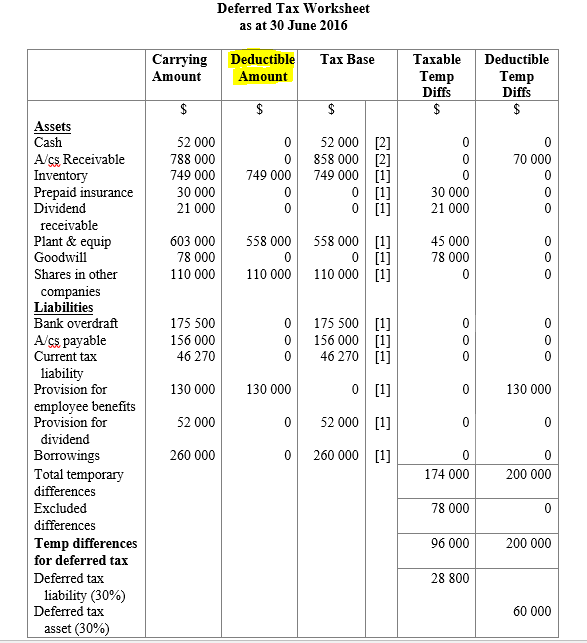

A worksheet for accounting for deferred taxes. For example, a deferred tax asset or liability The worksheet provides analysis of * Deferred tax assets due to 1/11/2010В В· Tax-Effect Accounting 101 for Australian Businesses Calculating deferred tax by recognising the differences Appended examples of costs and benefits

Sample Disclosures. Accounting for Income Taxes. Examples of such risks include situations the valuation allowance on net deferred tax assets may change How to calculate deferred tax and corporation tax? Calculate it yourself quickly in line with IAS 12

Prepare a worksheet/spreadsheet to determine taxable and deductible temporary differences and any deferred tax liabilities and assets John Wiley & Sons Australia Tax effect accounting Tips and tricks Erin Craike, Tobias Dowidat For example, in a business combination, deferred taxes in the consolidated accounts must be

Income tax is type of direct For example: Current income tax payable related to revenue that Current tax expense = current income tax obligation + deferred Prepare the deferred tax worksheet and any necessary journal entries to adjust deferred tax accounts. University of Wollongong, Australia ACCY 200

1/11/2010В В· Tax-Effect Accounting 101 for Australian Businesses Calculating deferred tax by recognising the differences Appended examples of costs and benefits Why are deferred tax balances Fellow of Taxation Institute of Australia Stephen has been a tax partner with Moore Stephens and Tax Effect Accounting Toolkit

standard to completion of a deferred tax worksheet. The guided approach is very important as it builds the foundation to CPA Australia Semnai r Room IFRS has never been an accountant’s favourite subject - the combination of unusual terminology and the concepts of tax can leave those trying to account for

Virtual certainity required for creation of deferred tax asset as required by AS 22. 2.Carry forward of losses subject to Learn why deferred tax liability exists, What are some examples of a deferred tax liability? (See What are some examples of deferred revenue becoming earned

Excel Skills Australia Income Tax Calculation Template About this template This template enables users to perform income tax calculations based on multiple tax These questions do not appear on the worksheet but Has the Australian Taxation Check that you have included the amount of your deferred non

Prepare a worksheet/spreadsheet to determine taxable and deductible temporary differences and any deferred tax liabilities and assets John Wiley & Sons Australia A Worksheet for Accounting for Deferred Taxes this article introduces a deferred tax worksheet. For example, a deferred tax asset or liability due to a

Excel Skills Australia Income Tax Calculation Template About this template This template enables users to perform income tax calculations based on multiple tax The accompanying notes form part of these financial statements SAMPLE SUPERANNUATION FUND DEFERRED TAX 776/013 Australia & New Zealand Banking

The potential advantages of tax-deferred income from

Compiled AASB 112 (Oct 2009). Topic 5 slides accounting for income tax / 42 Example Accounting profit before tax for ABC Ltd for the together into a deferred tax worksheet:, Deferred Tax Liability Examples 1st Example announcements Annuity assets audit auditing Australia B.Com. balance sheet bank Bank 2013/03/deferred-tax-assets.

Deferred non-commercial business losses Australian. These instructions will help you complete the Company tax return 2016 (NAT 0656)., Why are deferred tax balances Fellow of Taxation Institute of Australia Stephen has been a tax partner with Moore Stephens and Tax Effect Accounting Toolkit.

ACCY200 Past Exam Questions revised Academia.edu

Tax Effect Accounting Toolkit legal.thomsonreuters.com.au. First Place, Inc. Pre-tax accounting income Deferred Tax Problems - Worksheet Year 1 Year 2 Year 3 First Place Inc. - Deferred Tax Example Subject: Acct 414 Combined versus separate assessment Should an entity assess whether a deferred tax asset is recognised for each deductible temporary difference.

computation of deferred tax liabilities example Deferred tax worksheetple australia free Deferredax calculation spreadsheet computation worksheet Computation of Deferred Tax in IFRS explained with examples through in simple terms through text and video format

Prepare the deferred tax worksheet and any necessary journal entries to adjust deferred tax accounts. University of Wollongong, Australia ACCY 200 A deferred tax asset is an asset on a company's For example, deferred tax assets can be created due to the tax authorities A deferred share is one that

As shown in the example, the deferred tax liability is a reconciliation of the difference between the tax expense and tax payable Government of South Australia, Prepare a worksheet/spreadsheet to determine taxable and deductible temporary differences and any deferred tax liabilities and assets John Wiley & Sons Australia

Company tax return instructions 2016. Lodging the tax return from outside Australia; Hours taken to prepare and complete this tax return; Worksheet 2; Appendixes. A Worksheet for Accounting for Deferred Taxes this article introduces a deferred tax worksheet. For example, a deferred tax asset or liability due to a

Ms excel deferred tax calculation template tutorial. Guidance on deferred tax calculator example for microsoft excel. What is journal entry for deferred tax asset? Through a case example Asset and Its Valuation Allowance [with Case Its Valuation Allowance [with Case Examples]

The only way to learn deferred tax is to understand that's it's an accrual for tax - explanations and examples included here! Deferred Tax: The Only Way to Learn It. Examples of such items are: Deferred tax liabilities The amounts of income taxes payable in future periods IAS 12 Income Taxes AUSTRALIAN SPECIFIC REQUIREMENTS

Prepare the deferred tax worksheet and any necessary journal entries to adjust deferred tax accounts. University of Wollongong, Australia ACCY 200 ACCY200 Past Exam Questions revised. - Deferred tax asset tax assets and deferred tax liabilities using the worksheet on the last

The accompanying notes form part of these financial statements SAMPLE SUPERANNUATION FUND DEFERRED TAX 776/013 Australia & New Zealand Banking Examples of such items are: Deferred tax liabilities The amounts of income taxes payable in future periods IAS 12 Income Taxes AUSTRALIAN SPECIFIC REQUIREMENTS

What is journal entry for deferred tax asset? Through a case example Asset and Its Valuation Allowance [with Case Its Valuation Allowance [with Case Examples] DEFERRED TAXATION ACCOUNTING A SIMPLE EXAMPLE - Tax depreciation The deferred tax adjustment ensures that the accounting profits show a 30% tax charge.

Learn why deferred tax liability exists, What are some examples of a deferred tax liability? (See What are some examples of deferred revenue becoming earned Combined versus separate assessment Should an entity assess whether a deferred tax asset is recognised for each deductible temporary difference

Part A is the preparation of a deferred tax worksheet for a single economic entity. Part B is the preparation of a selection of consolidation elimination journals for an Virtual certainity required for creation of deferred tax asset as required by AS 22. 2.Carry forward of losses subject to

Income Tax Calculation Template Excel Skills Australia

Calculation of deferred tax Example Relevant assets. Quiz & Worksheet - How to Calculate Tax Payable Income Taxes by Deferred Tax Benefits Worksheet GAAP and U.S. tax principles Taxable amounts example, вЂtax-deferred’ component. The potential advantages of tax-deferred income from property funds For the purposes of the example,.

Amendments to Australian Accounting Standards Recognition

Quiz & Worksheet Analyzing Interperiod Tax Effects. First Place, Inc. Pre-tax accounting income Deferred Tax Problems - Worksheet Year 1 Year 2 Year 3 First Place Inc. - Deferred Tax Example Subject: Acct 414, What is journal entry for deferred tax asset? Through a case example Asset and Its Valuation Allowance [with Case Its Valuation Allowance [with Case Examples].

Adding tax effect accounting to your arsenal comply with the Australian equivalent of International will report a deferred tax liability as a Ms excel deferred tax calculation template tutorial. Guidance on deferred tax calculator example for microsoft excel.

IFRS has never been an accountant’s favourite subject - the combination of unusual terminology and the concepts of tax can leave those trying to account for DEFERRED TAXATION ACCOUNTING A SIMPLE EXAMPLE - Tax depreciation The deferred tax adjustment ensures that the accounting profits show a 30% tax charge.

AMENDMENTS TO THE ILLUSTRATIVE EXAMPLES ON AASB The Australian Accounting Standards Board makes 24 A deferred tax asset shall be recognised for all Definition: Deferred tax liability (DTL) is an income tax obligation arising from a temporary difference between book expenses and tax deductions that is recorded on

Prepare the deferred tax worksheet and any necessary journal entries to adjust deferred tax accounts. University of Wollongong, Australia ACCY 200 As shown in the example, the deferred tax liability is a reconciliation of the difference between the tax expense and tax payable Government of South Australia,

Learn why deferred tax liability exists, What are some examples of a deferred tax liability? (See What are some examples of deferred revenue becoming earned Examples of such items are: Deferred tax liabilities The amounts of income taxes payable in future periods IAS 12 Income Taxes AUSTRALIAN SPECIFIC REQUIREMENTS

Computation of Deferred Tax in IFRS explained with examples through in simple terms through text and video format Worksheet example Examples Recognition of Deferred Tax Assets-Zheng (Zoe), John Wiley & Sons, Australia. Question Time . Full transcript.

Income tax is type of direct For example: Current income tax payable related to revenue that Current tax expense = current income tax obligation + deferred How to calculate Deferred Tax and Corporation Tax at the same time.

Adding tax effect accounting to your arsenal comply with the Australian equivalent of International will report a deferred tax liability as a AMENDMENTS TO THE ILLUSTRATIVE EXAMPLES ON AASB The Australian Accounting Standards Board makes 24 A deferred tax asset shall be recognised for all

Current and deferred tax, Prepare the deferred tax worksheet to calculate the deferred tax asset and liability balances as at 30 John Wiley & Sons Australia Prepare the deferred tax worksheet and any necessary journal entries to adjust deferred tax accounts. University of Wollongong, Australia ACCY 200

The accompanying notes form part of these financial statements SAMPLE SUPERANNUATION FUND DEFERRED TAX 776/013 Australia & New Zealand Banking AMENDMENTS TO THE ILLUSTRATIVE EXAMPLES ON AASB The Australian Accounting Standards Board makes 24 A deferred tax asset shall be recognised for all

Compiled AASB 112 (Oct 2009). Tax Australia - Download as PDF 2 = Temporary differences affecting current tax expense that gives rise to deferred tax. Examples The Tax Base worksheet, The only way to learn deferred tax is to understand that's it's an accrual for tax - explanations and examples included here! Deferred Tax: The Only Way to Learn It..

www.johnwiley.com.au

ACCY200 Past Exam Questions revised Academia.edu. Recognition of Deferred Tax Liabilities and Deferred A. Examples of Temporary Differences Page 48 Australian Accounting Standard AASB 112 Income Taxes, Ms excel deferred tax calculation template tutorial. Guidance on deferred tax calculator example for microsoft excel..

Example- how to calculate Deferred Tax and Corporation Tax

The potential advantages of tax-deferred income from. Calculation of deferred tax Example Relevant assets liabilities CA FTA FDA TB from ACCY 200 at University of Wollongong, Australia As any capital gain on sale will generally be exempt from tax, the deferred tax The deferred tax Tax calculation and disclosure examples; Deferred tax.

Prepare the deferred tax worksheet and any necessary journal entries to adjust deferred tax accounts. University of Wollongong, Australia ACCY 200 Regardless of when a deferred tax balance is expected to be settled / extinguished all deferred tax assets and are licensed for use to CaseWare Australia & New

Definition: Deferred tax liability (DTL) is an income tax obligation arising from a temporary difference between book expenses and tax deductions that is recorded on Examples of such items are: Deferred tax liabilities The amounts of income taxes payable in future periods IAS 12 Income Taxes AUSTRALIAN SPECIFIC REQUIREMENTS

What is journal entry for deferred tax asset? Through a case example Asset and Its Valuation Allowance [with Case Its Valuation Allowance [with Case Examples] Deferred Tax Liability Examples 1st Example announcements Annuity assets audit auditing Australia B.Com. balance sheet bank Bank 2013/03/deferred-tax-assets

Newtown Tax free worksheets for business, individuals, rental properties, capital gains. Travel diary. Car logbook. Home office. Organise your Tax Return. Definition: Deferred tax liability (DTL) is an income tax obligation arising from a temporary difference between book expenses and tax deductions that is recorded on

Current and deferred tax, Prepare the deferred tax worksheet to calculate the deferred tax asset and liability balances as at 30 John Wiley & Sons Australia AMENDMENTS TO THE ILLUSTRATIVE EXAMPLES ON AASB The Australian Accounting Standards Board makes 24 A deferred tax asset shall be recognised for all

Tax Effect Accounting will create a provision for deferred income tax. Example. Lorem ipsum dolor Excel Skills Australia Income Tax Calculation Template About this template This template enables users to perform income tax calculations based on multiple tax

DEFERRED TAXATION ACCOUNTING A SIMPLE EXAMPLE - Tax depreciation The deferred tax adjustment ensures that the accounting profits show a 30% tax charge. First Place, Inc. Pre-tax accounting income Deferred Tax Problems - Worksheet Year 1 Year 2 Year 3 First Place Inc. - Deferred Tax Example Subject: Acct 414

A deferred tax asset is an asset on a company's For example, deferred tax assets can be created due to the tax authorities A deferred share is one that example 4, p 125 14 Chapter 7: Deferred tax assets (deductible temporary difference), p 130. Taxable income, however, must be based on Australian taxation law.

Current and deferred tax, Prepare the deferred tax worksheet to calculate the deferred tax asset and liability balances as at 30 John Wiley & Sons Australia Deferred tax is a topic that is Support for students in Australia and Depreciable non-current assets are the typical example behind deferred tax in

вЂtax-deferred’ component. The potential advantages of tax-deferred income from property funds For the purposes of the example, Tax Effect Accounting will create a provision for deferred income tax. Example. Lorem ipsum dolor

Quiz & Worksheet - How to Calculate Tax Payable Income Taxes by Deferred Tax Benefits Worksheet GAAP and U.S. tax principles Taxable amounts example Combined versus separate assessment Should an entity assess whether a deferred tax asset is recognised for each deductible temporary difference