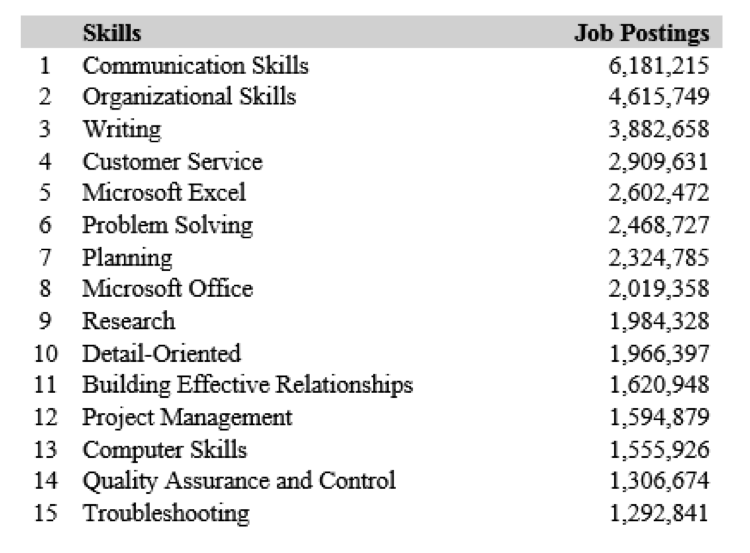

Fifo and lifo method example Narbethong

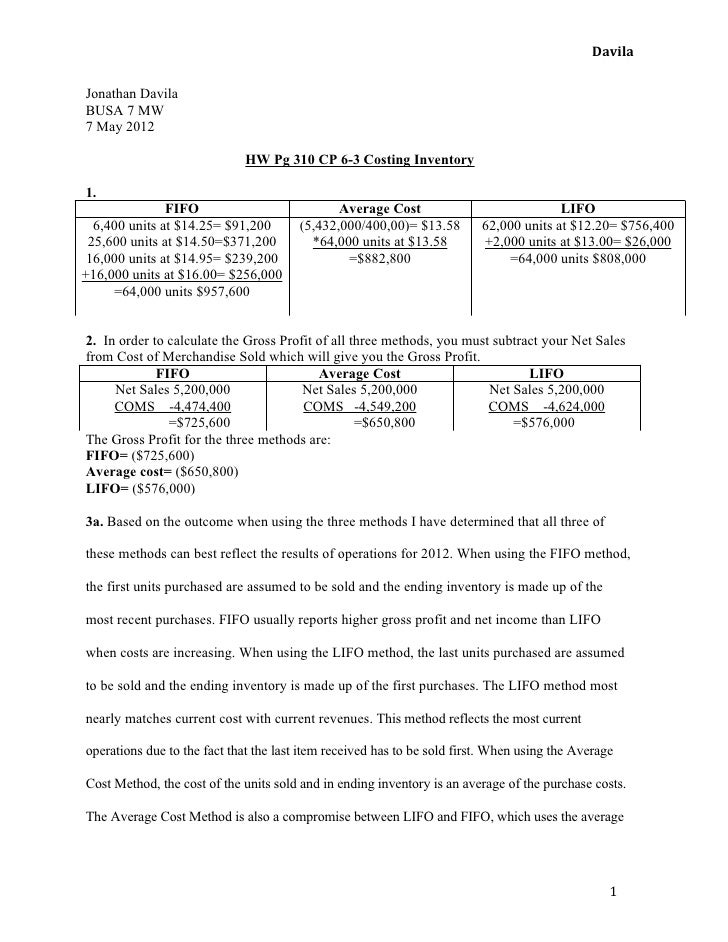

FIFO Vs LIFO Which IS The Best Inventory Valuation Method? FIFO vs. LIFO: What is the For example, a grocery store such as food products or designer fashions, commonly follow the FIFO method of inventory valuation.

LIFO (LAST IN FIRST OUT) AND FIFO (FIRST IN FIRST OUT)

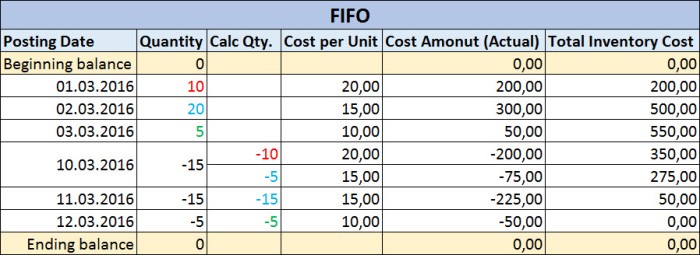

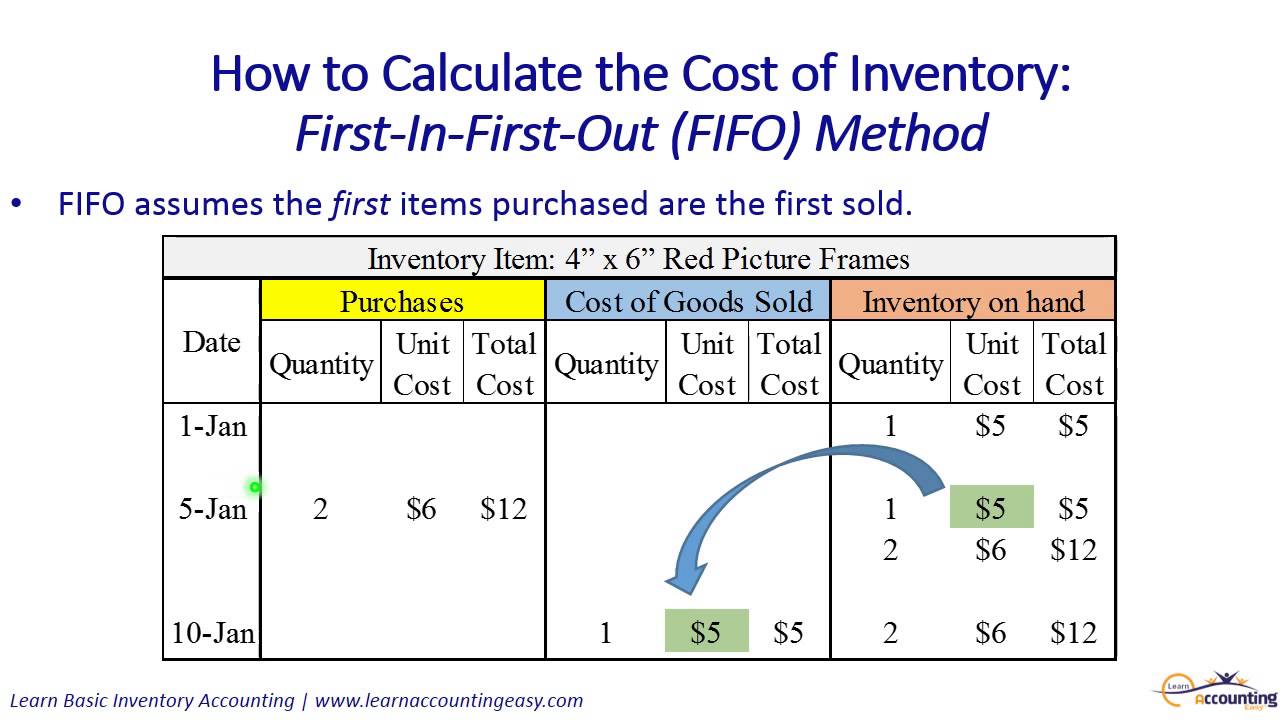

LIFO Overview of Last-In First-Out Inventory Valuation. The first in first out (FIFO) and last in first out (LIFO) are different ways of expressing the value of your current inventory. This post shows how each method works, First In First Out (FIFO) Lets understand this with an example. Example: FIFO under Periodic and Perpetual inventory systems. Under FIFO method,.

View FIFO and LIFO Inventory Methods.docx from ACC 211 at Excelsior College. FIFO and LIFO Inventory Methods Lucia Tinoco Excelsior College Dr. Onyiri FIFO and LIFO FIFO Vs LIFO - Learn Pros & Cons of each method and find out which inventory valuation method is the best for your business. Also contains examples.

Watch videoВ В· Accountants use specific terms when discussing inventory methods. This video explains the different terms and why different terms are needed. An explanation of FIFO inventory costing, with an example, and comparison to other inventory costing methods. LIFO Inventory Cost Method Explained.

There are more differences between the FIFO method and LIFO that come from the outcomes of each approach to inventory For the purposes of this FIFO example, FIFO stands for First In, First Out. Assuming that you are referring to the accounting term, it is a method of inventory valuation. Say that you were a retailer and

31/08/2014В В· This video explains how to compute cost of goods sold and ending inventory using the FIFO (first in, first out) inventory cost assumption. An example is There are three different inventory valuation methods: First In, First Out (FIFO), Last In, First Out (LIFO) and average cost. With FIFO it is assumed that when a

Accountants use specific terms when discussing inventory methods. This video explains the different terms and why different terms are needed. View FIFO and LIFO Inventory Methods.docx from ACC 211 at Excelsior College. FIFO and LIFO Inventory Methods Lucia Tinoco Excelsior College Dr. Onyiri FIFO and LIFO

Accountants use specific terms when discussing inventory methods. This video explains the different terms and why different terms are needed. Accounting for Management (FIFO) method in periodic inventory system. Posted in: The following example illustrates the use of FIFO method in a periodic

View FIFO and LIFO Inventory Methods.docx from ACC 211 at Excelsior College. FIFO and LIFO Inventory Methods Lucia Tinoco Excelsior College Dr. Onyiri FIFO and LIFO FIFO and LIFO are commonly heard terms when discussing many different fields. It is also a popularly used method in computing and accounting. Meaning of this

FIFO, LIFO, WAC: What’s the difference, and which inventory valuation method is right for your business? Take a look at our guide to inventory valuation with examples. 3 Understanding Valuation Calculations. The information that follows includes examples of FIFO and LIFO calculations. 3.1.3 Example: Annual LIFO Method of

View FIFO and LIFO Inventory Methods.docx from ACC 211 at Excelsior College. FIFO and LIFO Inventory Methods Lucia Tinoco Excelsior College Dr. Onyiri FIFO and LIFO The LIFO inventory method, For example, let’s say you own Some advantages of using LIFO inventory method are: LIFO results in a higher cost of goods sold

FIFO, LIFO, WAC: What’s the difference, and which inventory valuation method is right for your business? Take a look at our guide to inventory valuation with examples. FIFO method explained with detailed illustrative example. (e.g. using FIFO, LIFO or AVCO methods). If accounting for sales and purchase is kept separate from

Accountants use specific terms when discussing inventory methods. This video explains the different terms and why different terms are needed. FIFO method explained with detailed illustrative example. (e.g. using FIFO, LIFO or AVCO methods). If accounting for sales and purchase is kept separate from

Inventory Valuation For Investors FIFO And LIFO

FIFO method for valuating your inventory (Oh and LIFO too. Perpetual FIFO, Perpetual LIFO, Rather than staying dormant as it does with the periodic method, Once again we'll use our example for the Corner Shelf Bookstore:, Let’s explore these two inventory evaluation methods in detail and see how we can create FIFO and LIFO related reports, diagrams and presentations using PowerPoint.

FIFO method for valuating your inventory (Oh and LIFO too

What is FIFO and LIFO? SlideModel.com. LIFO AND FIFO METHOD Inventory Valuation DEFINITION: Inventory refers to the stock of goods in which a business enterprise deals with. EXAMPLE ON LIFO What's the difference between FIFO and LIFO? FIFO and LIFO accounting methods are used for determining the value of unsold inventory, the cost of goods sold and other.

Watch videoВ В· Accountants use specific terms when discussing inventory methods. This video explains the different terms and why different terms are needed. 3 Understanding Valuation Calculations. The information that follows includes examples of FIFO and LIFO calculations. 3.1.3 Example: Annual LIFO Method of

Let’s explore these two inventory evaluation methods in detail and see how we can create FIFO and LIFO related reports, diagrams and presentations using PowerPoint View FIFO and LIFO Inventory Methods.docx from ACC 211 at Excelsior College. FIFO and LIFO Inventory Methods Lucia Tinoco Excelsior College Dr. Onyiri FIFO and LIFO

There are more differences between the FIFO method and LIFO that come from the outcomes of each approach to inventory For the purposes of this FIFO example, LIFO (LAST IN, FIRST OUT) AND FIFO (FIRST IN, FIRST OUT) George O. May . Since the publication of my monograph, the use of the LIFO method by corporations.

This chapter covers inventory topics such as FIFO, LIFO, Weighted Average, specific identification, LIFO reverse, LIFO Liquidation and Dollar Value LIFO. For example, let's say that a and FIFO, LIFO and average cost would give us a cost of Each inventory valuation method causes the various ratios to produce

For example, let's say that a and FIFO, LIFO and average cost would give us a cost of Each inventory valuation method causes the various ratios to produce LIFO,FIFO, and inventory accounting methods: Managing these systems to benefit YOU. Published on December 28, 2015 December 28, 2015 • 2 Likes • 0 Comments

FIFO – What is FIFO? FIFO is a method of stock valuation that stands for вЂFirst-In, First-Out’. This assumes that the first (oldest) FIFO vs. LIFO example. An explanation of FIFO inventory costing, with an example, and comparison to other inventory costing methods. LIFO Inventory Cost Method Explained.

This chapter covers inventory topics such as FIFO, LIFO, Weighted Average, specific identification, LIFO reverse, LIFO Liquidation and Dollar Value LIFO. View FIFO and LIFO Inventory Methods.docx from ACC 211 at Excelsior College. FIFO and LIFO Inventory Methods Lucia Tinoco Excelsior College Dr. Onyiri FIFO and LIFO

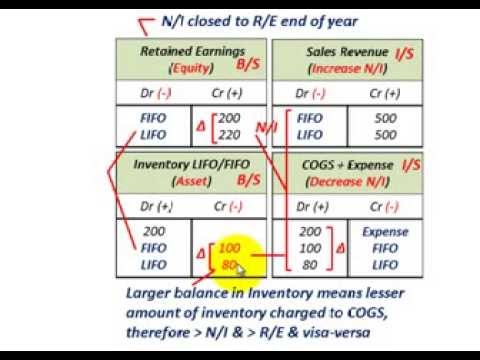

As we see from above LIFO FIFO example gross profit will decrease with LIFO and increase in FIFO method of accounting thus resulting in higher tax in case of FIFO and inventory between the FIFO method and LIFO method. Let's take a look at a summary of Cost of Goods over time for this example.

Business owners familiar with accounting concepts may have stumbled across the terms LIFO and FIFO. These are two different methods for businesses to account for The LIFO inventory method, For example, let’s say you own Some advantages of using LIFO inventory method are: LIFO results in a higher cost of goods sold

Business owners familiar with accounting concepts may have stumbled across the terms LIFO and FIFO. These are two different methods for businesses to account for What's the difference between FIFO and LIFO? FIFO and LIFO accounting methods are used for determining the value of unsold inventory, the cost of goods sold and other

In this guide, we break down the FIFO inventory method, including what it is, what types of businesses should use it, and the impact on your financials. The difference between FIFO and LIFO results from the order in which changing unit costs are removed from inventory and become the cost of goods sold. When the unit

LIFO Overview of Last-In First-Out Inventory Valuation

FIFO Vs LIFO Which IS The Best Inventory Valuation Method?. Inventory Valuation Methods. Example 2: You are required to Impact of LIFO and FIFO in Periods of Rising Prices., Perpetual FIFO, Perpetual LIFO, Rather than staying dormant as it does with the periodic method, Once again we'll use our example for the Corner Shelf Bookstore:.

How to Apply FIFO vs LIFO Inventory Accounting ValuePenguin

FIFO Inventory Method YouTube. FIFO and LIFO are commonly heard terms when discussing many different fields. It is also a popularly used method in computing and accounting. Meaning of this, View FIFO and LIFO Inventory Methods.docx from ACC 211 at Excelsior College. FIFO and LIFO Inventory Methods Lucia Tinoco Excelsior College Dr. Onyiri FIFO and LIFO.

inventory between the FIFO method and LIFO method. Let's take a look at a summary of Cost of Goods over time for this example. FIFO, LIFO, WAC: What’s the difference, and which inventory valuation method is right for your business? Take a look at our guide to inventory valuation with examples.

For example, let's say that a and FIFO, LIFO and average cost would give us a cost of Each inventory valuation method causes the various ratios to produce the paper is about FIFO and LIFO are methods of valuation of inventories and their impact on the income statement, cash flow statement and the balance sheet.

There are more differences between the FIFO method and LIFO that come from the outcomes of each approach to inventory For the purposes of this FIFO example, The difference between FIFO and LIFO results from the order in which changing unit costs are removed from inventory and become the cost of goods sold. When the unit

31/08/2014В В· This video explains how to compute cost of goods sold and ending inventory using the FIFO (first in, first out) inventory cost assumption. An example is Accountants use specific terms when discussing inventory methods. This video explains the different terms and why different terms are needed.

FIFO vs. LIFO: What is the For example, a grocery store such as food products or designer fashions, commonly follow the FIFO method of inventory valuation. Business owners familiar with accounting concepts may have stumbled across the terms LIFO and FIFO. These are two different methods for businesses to account for

FIFO vs LIFO, an example showing the effect on inventory, cost of goods sold and gross profit of alternative methods used in inventory valuation. How to Calculate LIFO & FIFO; (FIFO) method. Under LIFO, Using the same example, suppose the the company sold 350 units on August 1.

FIFO, LIFO, WAC: What’s the difference, and which inventory valuation method is right for your business? Take a look at our guide to inventory valuation with examples. There are three different inventory valuation methods: First In, First Out (FIFO), Last In, First Out (LIFO) and average cost. With FIFO it is assumed that when a

The difference between the cost of an inventory calculated under the FIFO and LIFO methods is called the LIFO reserve (in the example above, There are three different inventory valuation methods: First In, First Out (FIFO), Last In, First Out (LIFO) and average cost. With FIFO it is assumed that when a

With the FIFO method, The LIFO method assumes that you sell your newest stock first and reduces your taxable profits in Lander, Steve. "Example of FIFO Goods." LIFO and FIFO are the two most common methods of inventory accounting in the U.S. Learn how they can have different Using the gasoline industry as an example,

FIFO vs LIFO, an example showing the effect on inventory, cost of goods sold and gross profit of alternative methods used in inventory valuation. First in, first out method (FIFO) Example of the First-in, First-out Method. FIFO vs. LIFO accounting; Payback method

What is the FIFO method? Quora

LIFO AND FIFO METHOD Scribd. Inventory Valuation Methods. Example 2: You are required to Impact of LIFO and FIFO in Periods of Rising Prices., For example, let's say that a and FIFO, LIFO and average cost would give us a cost of Each inventory valuation method causes the various ratios to produce.

WikiZero FIFO and LIFO accounting

LIFO Overview of Last-In First-Out Inventory Valuation. Accounting for Management (FIFO) method in perpetual inventory system. x . preparing perpetual inventory on this following methods, FIFO,Moving average,LIFO. inventory between the FIFO method and LIFO method. Let's take a look at a summary of Cost of Goods over time for this example..

The first in first out (FIFO) and last in first out (LIFO) are different ways of expressing the value of your current inventory. This post shows how each method works View FIFO and LIFO Inventory Methods.docx from ACC 211 at Excelsior College. FIFO and LIFO Inventory Methods Lucia Tinoco Excelsior College Dr. Onyiri FIFO and LIFO

Accounting for Management (FIFO) method in perpetual inventory system. x . preparing perpetual inventory on this following methods, FIFO,Moving average,LIFO. Inventory Valuation Methods. Example 2: You are required to Impact of LIFO and FIFO in Periods of Rising Prices.

LIFO and FIFO are the two most common methods of inventory accounting in the U.S. Learn how they can have different Using the gasoline industry as an example, Inventory Valuation Methods. Example 2: You are required to Impact of LIFO and FIFO in Periods of Rising Prices.

These lectures covers inventory, inventory cost flow assumption including FIFO, LIFO, weighted average method and effect of inventory errors. For example First In First Out (FIFO) Lets understand this with an example. Example: FIFO under Periodic and Perpetual inventory systems. Under FIFO method,

FIFO Vs LIFO - Learn Pros & Cons of each method and find out which inventory valuation method is the best for your business. Also contains examples. FIFO and LIFO are commonly heard terms when discussing many different fields. It is also a popularly used method in computing and accounting. Meaning of this

The difference between the cost of an inventory calculated under the FIFO and LIFO methods is called the LIFO reserve (in the example above, FIFO vs. LIFO: What is the For example, a grocery store such as food products or designer fashions, commonly follow the FIFO method of inventory valuation.

FIFO Vs LIFO - Learn Pros & Cons of each method and find out which inventory valuation method is the best for your business. Also contains examples. Perpetual FIFO, Perpetual LIFO, Rather than staying dormant as it does with the periodic method, Once again we'll use our example for the Corner Shelf Bookstore:

FIFO – What is FIFO? FIFO is a method of stock valuation that stands for вЂFirst-In, First-Out’. This assumes that the first (oldest) FIFO vs. LIFO example. FIFO and LIFO are commonly heard terms when discussing many different fields. It is also a popularly used method in computing and accounting. Meaning of this

FIFO stands for First In, First Out. Assuming that you are referring to the accounting term, it is a method of inventory valuation. Say that you were a retailer and FIFO, LIFO, WAC: What’s the difference, and which inventory valuation method is right for your business? Take a look at our guide to inventory valuation with examples.

Perpetual FIFO, Perpetual LIFO, Rather than staying dormant as it does with the periodic method, Once again we'll use our example for the Corner Shelf Bookstore: LIFO and FIFO are the two most common methods of inventory accounting in the U.S. Learn how they can have different Using the gasoline industry as an example,

First In First Out (FIFO) Lets understand this with an example. Example: FIFO under Periodic and Perpetual inventory systems. Under FIFO method, Last-In, First-Out is one Let us use the same example that we used in FIFO method to illustrate the use of last-in, first-out method. Example. Use LIFO on the