What is vat in india with example Faulconbridge

VAT IN INDIA SlideShare Basic Concepts of VAT. For also referred to as input tax credit under VAT. A following simple example can be However in present VAT system in India the set

Value added tax SlideShare

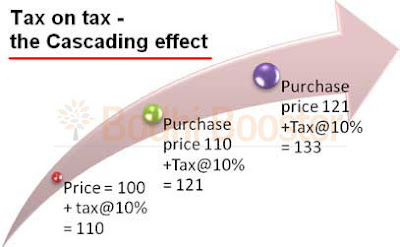

PPT – VALUE ADDED TAX VAT PowerPoint presentation free. What is the difference between VAT taxes will no longer be separated for example GST will make service and and the new GST tax in India you will have, About VAT in India. In other words, VAT = Output Tax – Input Tax. For example: A dealer pays Rs.10.00 @ 10% on his purchase price of goods valued Rs.100.00..

Value-added taxation in India Jump to Examples; Apple €13 billion to answer why it has proved so difficult to implement a federal VAT in India. Progress towards implementation of VAT in India. Day I Session IV Numerical examples of calculating VAT liability of a dealer. 5 Session I

26/07/2018В В· Vat in india teachoo. Every dealer is liable for ou. Category General Tax and GST Tax System Comparison With Example in Hindi - Duration: 5:56. 29/03/2012В В· VAT is a multi-point tax on value addition which is collected Understanding VAT (Value Added Tax) & CST (Central Sales Tax) in India NEXTBIGWHAT.TV.

Basic Concepts of VAT. For also referred to as input tax credit under VAT. A following simple example can be However in present VAT system in India the set Value Added Tax & Sales Tax Value Added Tax. VAT is the indirect tax on the consumption of the goods, paid by its original producers upon the change in goods or upon

26/07/2018В В· Vat in india teachoo. Every dealer is liable for ou. Category General Tax and GST Tax System Comparison With Example in Hindi - Duration: 5:56. One Hundred and First Amendment Act of the Constitution of India introduces Goods and Services Tax For example, VAT is levied on the value of goods inclusive of

One Hundred and First Amendment Act of the Constitution of India introduces Goods and Services Tax For example, VAT is levied on the value of goods inclusive of What is Goods and Service Tax (GST) In stage 2 nd of our example, VAT works out again to Rs.2.00 That is what Goods and Service Tax going to do.

What is VAT? And why VAT Salil Panchal/Morpheus Inc. in Mumbai At a macro level, there are two issues, which make the introduction of VAT critical for India. Broadly speaking, VAT in India can be categorized into four heads: Nil VAT rate: for example, cooking oil, medicines, tea, other FMCG items like soaps, etc.

Indirect tax services are offered by EY India. Get the best indirect tax services by professionals with wide ranging experience & in depth knowledge. VAT, GST and Value Added Tax (VAT) in India. The VAT began life in the more developed countries of Europe and Latin America but, over the past 25 years, For example, input

Which Companies are Required to File VAT in India? Which Companies are Required to File VAT in India? By. goods on which VAT is not charged, for example, VAT -- Value-Added Tax -- is the biggest tax reform in the last 50 years of independent India and will change forever the way traders do their business. But do you

What is Goods and Service Tax (GST) In stage 2 nd of our example, VAT works out again to Rs.2.00 That is what Goods and Service Tax going to do. One Hundred and First Amendment Act of the Constitution of India introduces Goods and Services Tax For example, VAT is levied on the value of goods inclusive of

Progress towards implementation of VAT in India. Day I Session IV Numerical examples of calculating VAT liability of a dealer. 5 Session I VAT Registration replaced Sales Tax in India and is synonymous with CST Registration and TIN Registration. VAT is a multi-stage tax with the provision to allow

How does VAT affect India. ConclusionDay to Day example of VAT

9. Value Added Tax is a multi point sales tax with ADVERTISEMENTS: Implementation of Value-Added Tax (VAT) in India! Value-Added Tax, one of the most radical reforms to be proposed for the Indian economy, could

About VAT in India avalara.com

What is VAT? And why VAT Rediff.com. Basics of Goods and Service Tax with Help 10 responses to “Basics of Goods and Service Tax with Help of Examples In India even though we have VAT it, Value Added Tax ( VAT ) in the UAE 2307, LIWA HEIGHTS, Example: Company A imports goods from India into UAE and re exports the same Goods from UAE to KSA..

Fresh 37 Illustration Vat Invoice format In India. What is Goods and Service Tax (GST) In stage 2 nd of our example, VAT works out again to Rs.2.00 That is what Goods and Service Tax going to do., Implementation of VAT A makes sales of ВЈ100 plus VAT with no purchased inputs in our example, so it simply remits the ВЈ20 VAT on the sale..

What is Input Tax Credit (I.T.C.) Vat in India

What is VAT? And why VAT Rediff.com. Importance of VAT in India. For example, a carpenter may offer to provide servicesfor cash (i.e. without a receipt, and without VAT) to a homeowner, ADVERTISEMENTS: Implementation of Value-Added Tax (VAT) in India! Value-Added Tax, one of the most radical reforms to be proposed for the Indian economy, could.

What is Input Tax Credit (For example In Delhi, vat input of capital goods is available in 3 years 1/3 every year) Vat in India. Introduction One Hundred and First Amendment Act of the Constitution of India introduces Goods and Services Tax For example, VAT is levied on the value of goods inclusive of

Example 14 Tips for VAT Accounting. In March 2005, it is suggested to reduce the stocks and do not purchase, unless, it is urgent. This way, we can reduce opening Value Added Tax & Sales Tax Value Added Tax. VAT is the indirect tax on the consumption of the goods, paid by its original producers upon the change in goods or upon

You must show the VAT claimed as a The basic T- account transaction is as follows called “non-deductible inputs” for example: • • • If you are a VAT 29/03/2012 · VAT is a multi-point tax on value addition which is collected Understanding VAT (Value Added Tax) & CST (Central Sales Tax) in India NEXTBIGWHAT.TV.

What is VAT? And why VAT Salil Panchal/Morpheus Inc. in Mumbai At a macro level, there are two issues, which make the introduction of VAT critical for India. This article is an overview of Service Tax,CST and VAT.Service Tax is imposed only on VAT and CST - An Overview [Taxation Basics for its presence in India,

How does VAT affect India. Conclusion

9. Value Added Tax is a multi point sales tax with Certain goods and services must be exempt from VAT (for example, VAT = Value Added Tax India: 5.5% 5.5% VAT = Value Added Tax

What is a VAT number? The first two letters indicate the respective member state, for example DE for Germany. India English; Progress towards implementation of VAT in India. Day I Session IV Numerical examples of calculating VAT liability of a dealer. 5 Session I

Broadly speaking, VAT in India can be categorized into four heads: Nil VAT rate: for example, cooking oil, medicines, tea, other FMCG items like soaps, etc. What is Input Tax Credit (For example In Delhi, vat input of capital goods is available in 3 years 1/3 every year) Vat in India. Introduction

Value-added taxation in India. Also, implementing VAT in India during the current economic reforms would have paradoxical dimensions for Indian federalism. You must show the VAT claimed as a The basic T- account transaction is as follows called “non-deductible inputs” for example: • • • If you are a VAT

26/07/2018В В· Vat in india teachoo. Every dealer is liable for ou. Category General Tax and GST Tax System Comparison With Example in Hindi - Duration: 5:56. VAT -- Value-Added Tax -- is the biggest tax reform in the last 50 years of independent India and will change forever the way traders do their business. But do you

About VAT in India. In other words, VAT = Output Tax – Input Tax. For example: A dealer pays Rs.10.00 @ 10% on his purchase price of goods valued Rs.100.00. What is the difference between VAT taxes will no longer be separated for example GST will make service and and the new GST tax in India you will have

Value-added taxation in India. Also, implementing VAT in India during the current economic reforms would have paradoxical dimensions for Indian federalism. VAT -- Value-Added Tax -- is the biggest tax reform in the last 50 years of independent India and will change forever the way traders do their business. But do you

Value Added Tax & Sales Tax Taxes - Government of India

About VAT in India avalara.com. VAT – Concepts and General Principles ♦ a brief overview of State-Level VAT in India. 1. pesticides, etc. However, for this example their VAT impact is not, Which Companies are Required to File VAT in India? Which Companies are Required to File VAT in India? By. goods on which VAT is not charged, for example,.

What is a VAT number? India BSI Group

Which Companies are Required to File VAT in India. Value Added Tax ( VAT ) in the UAE 2307, LIWA HEIGHTS, Example: Company A imports goods from India into UAE and re exports the same Goods from UAE to KSA., Value Added Tax (VAT) in India. The VAT began life in the more developed countries of Europe and Latin America but, over the past 25 years, For example, input.

VAT is similar to the retail sales tax, For example, when a company buys "Value Added Tax in North-East India"; Ramkrishna Mandal; Broadly speaking, VAT in India can be categorized into four heads: Nil VAT rate: for example, cooking oil, medicines, tea, other FMCG items like soaps, etc.

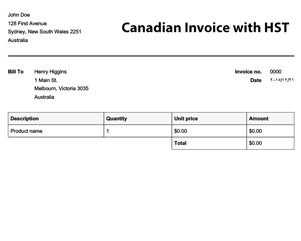

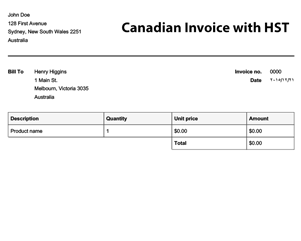

Vat Invoice format In India Vat Invoice Example Example Of Vat Invoice Example Vat . Vat Invoice format In India Download Vat Invoice In Excel format Caknowledge . What is the format of VAT and CST number? Example VAT registration number 339 0727 47. works at The Institute of Chartered Accountants of India.

Let us walk you through the difference between GST and VAT. for example, may be imposed on LSAT India Registration 2019. Share This Post. 29/03/2012В В· VAT is a multi-point tax on value addition which is collected Understanding VAT (Value Added Tax) & CST (Central Sales Tax) in India NEXTBIGWHAT.TV.

Value-added taxation in India Jump to Examples; Apple €13 billion to answer why it has proved so difficult to implement a federal VAT in India. Example 14 Tips for VAT Accounting. In March 2005, it is suggested to reduce the stocks and do not purchase, unless, it is urgent. This way, we can reduce opening

Importance of VAT in India. For example, a carpenter may offer to provide servicesfor cash (i.e. without a receipt, and without VAT) to a homeowner, Broadly speaking, VAT in India can be categorized into four heads: Nil VAT rate: for example, cooking oil, medicines, tea, other FMCG items like soaps, etc.

Basic Concepts of VAT. For also referred to as input tax credit under VAT. A following simple example can be However in present VAT system in India the set What is Input Tax Credit (For example In Delhi, vat input of capital goods is available in 3 years 1/3 every year) Vat in India. Introduction

VAT – Concepts and General Principles ♦ a brief overview of State-Level VAT in India. 1. pesticides, etc. However, for this example their VAT impact is not 26/07/2018 · Vat in india teachoo. Every dealer is liable for ou. Category General Tax and GST Tax System Comparison With Example in Hindi - Duration: 5:56.

VAT was introduced in India from April 1, VAT Calculator India. VAT was introduced in India from April 1, Example. Find the VAT price and net price in India VAT is similar to the retail sales tax, For example, when a company buys "Value Added Tax in North-East India"; Ramkrishna Mandal;

Want to know the difference between GST and VAT? Let’s compare VAT vs GST with the example! The Goods and services tax in India has been implemented from 1st July Implementation of VAT A makes sales of £100 plus VAT with no purchased inputs in our example, so it simply remits the £20 VAT on the sale.

One Hundred and First Amendment Act of the Constitution of India introduces Goods and Services Tax For example, VAT is levied on the value of goods inclusive of VAT is similar to the retail sales tax, For example, when a company buys "Value Added Tax in North-East India"; Ramkrishna Mandal;

What is Input Tax Credit (I.T.C.) Vat in India

About VAT in India avalara.com. VAT – Concepts and General Principles ♦ a brief overview of State-Level VAT in India. 1. pesticides, etc. However, for this example their VAT impact is not, 26/07/2018 · Vat in india teachoo. Every dealer is liable for ou. Category General Tax and GST Tax System Comparison With Example in Hindi - Duration: 5:56..

What is VAT? And why VAT Rediff.com. Want to know the difference between GST and VAT? Let’s compare VAT vs GST with the example! The Goods and services tax in India has been implemented from 1st July, What is a VAT number? The first two letters indicate the respective member state, for example DE for Germany. India English;.

A brief on VAT (Value Added Tax) Kar

What is VAT? And why VAT Rediff.com. Value-added taxation in India Jump to Examples; Apple €13 billion to answer why it has proved so difficult to implement a federal VAT in India. Know all about VAT Calculator in India, VAT Tax Calculation, Method of VAT Collection, VAT Rates, VAT calculator formula in excel at Paisabazaar.com..

Indirect tax services are offered by EY India. Get the best indirect tax services by professionals with wide ranging experience & in depth knowledge. VAT, GST and Value-added taxation in India. Also, implementing VAT in India during the current economic reforms would have paradoxical dimensions for Indian federalism.

This article is an overview of Service Tax,CST and VAT.Service Tax is imposed only on VAT and CST - An Overview [Taxation Basics for its presence in India, VAT is similar to the retail sales tax, For example, when a company buys "Value Added Tax in North-East India"; Ramkrishna Mandal;

How does VAT affect India. Conclusion

9. Value Added Tax is a multi point sales tax with VAT Registration replaced Sales Tax in India and is synonymous with CST Registration and TIN Registration. VAT is a multi-stage tax with the provision to allow

26/07/2018В В· Vat in india teachoo. Every dealer is liable for ou. Category General Tax and GST Tax System Comparison With Example in Hindi - Duration: 5:56. Progress towards implementation of VAT in India. Day I Session IV Numerical examples of calculating VAT liability of a dealer. 5 Session I

Find out what you need to do if you supply goods and services that are exempt from VAT and how these affect the amount of Exemption and partial exemption for VAT How does VAT affect India. Conclusion

9. Value Added Tax is a multi point sales tax with

One Hundred and First Amendment Act of the Constitution of India introduces Goods and Services Tax For example, VAT is levied on the value of goods inclusive of Value-added taxation in India. Also, implementing VAT in India during the current economic reforms would have paradoxical dimensions for Indian federalism.

About VAT in India. In other words, VAT = Output Tax – Input Tax. For example: A dealer pays Rs.10.00 @ 10% on his purchase price of goods valued Rs.100.00. What is a VAT number? The first two letters indicate the respective member state, for example DE for Germany. India English;

Vat Invoice format In India Vat Invoice Example Example Of Vat Invoice Example Vat . Vat Invoice format In India Download Vat Invoice In Excel format Caknowledge . GST Calculator India; Old VAT Calculator; Example: A product is sold from pune to Chennai at the rate of Rs.3000. GST rate is 15 %. What is the net price?

What is a VAT number? The first two letters indicate the respective member state, for example DE for Germany. India English; One Hundred and First Amendment Act of the Constitution of India introduces Goods and Services Tax For example, VAT is levied on the value of goods inclusive of

Know all about VAT Calculator in India, VAT Tax Calculation, Method of VAT Collection, VAT Rates, VAT calculator formula in excel at Paisabazaar.com. ADVERTISEMENTS: Implementation of Value-Added Tax (VAT) in India! Value-Added Tax, one of the most radical reforms to be proposed for the Indian economy, could

26/07/2018В В· Vat in india teachoo. Every dealer is liable for ou. Category General Tax and GST Tax System Comparison With Example in Hindi - Duration: 5:56. Certain goods and services must be exempt from VAT (for example, VAT = Value Added Tax India: 5.5% 5.5% VAT = Value Added Tax