Capital asset pricing model example questions Coalstoun Lakes

Chapter 11 Capital Asset Pricing Model (CAPM) Yola depended primarily on the manner in which that asset was п¬Ѓnanced (for example, In short, before the arrival of the Capital Asset Pricing Model, the question of how

ACCA P4 Free lecture The Capital Asset Pricing Model

The Capital Asset Pricing Model pubs.aeaweb.org. Capital Asset Pricing Model Assume for example an electric appliances company is considering investment in the development of a new CFA Style Questions, Questions & Answers; The Capital Asset Pricing Model is a mathematically simple estimate of the cost of equity Cost of An example of a beta regression.

investment management chapter vii the capital asset pricing model capital asset pricing model (capm) model of financial market equilibrium that allows the This raises the question “What should the price be?” The well-known Sharpe-Lintner capital asset pricing model An example of the model:

Capital Asset Pricing Model Assume for example an electric appliances company is considering investment in the development of a new CFA Style Questions The course emphasizes real-world examples and applications of the Separation Theorem of investments • Use the Capital Asset Pricing Model The question, and

Questions & Answers; The Capital Asset Pricing Model is a mathematically simple estimate of the cost of equity Cost of An example of a beta regression Dear Sir, regarding APV, I have got a few questions which I hope you could help me with. Suppose a company has been quoted a price of around ВЈ1m to acquire an asset

Questions & Answers; The Capital Asset Pricing Model is a mathematically simple estimate of the cost of equity Cost of An example of a beta regression Home В» Accounting Dictionary В» What is Capital Asset Pricing Model The capital asset pricing model or CAPM is a method of Questions; Examples;

Dear Sir, regarding APV, I have got a few questions which I hope you could help me with. Suppose a company has been quoted a price of around ВЈ1m to acquire an asset Chapter 10The Capital Asset Pricing model OPEN QUESTIONS 1. You can borrow and lend at the risk-free rate of 8%. The return on the optima...

The Capital Asset Pricing Model (CAPM) is an economic model for valuing stocks, securities, derivatives and/or assets by relating risk and expected return Sample Questions 3. MULTIPLE CHOICE QUESTIONS 1- The Capital Asset Pricing Model: a. has serious flaws because of its complexity. b. measures relevant risk of a

Capital Asset Pricing Model Capital Asset Pricing Model (CAPM) Capital market theory extends portfolio theory and develops a model for pricing all risky assets. Question: Why do some financial assets tend to earn higher returns than others? As an example, 4 Responses to “Tutorial: The Capital Asset Pricing Model

This raises the question “What should the price be?” The well-known Sharpe-Lintner capital asset pricing model An example of the model: Dear Sir, regarding APV, I have got a few questions which I hope you could help me with. Suppose a company has been quoted a price of around £1m to acquire an asset

Home В» Accounting Dictionary В» What is Capital Asset Pricing Model The capital asset pricing model or CAPM is a method of Questions; Examples; Chapter 10The Capital Asset Pricing model OPEN QUESTIONS 1. You can borrow and lend at the risk-free rate of 8%. The return on the optima...

The capital asset pricing model of the simple model. But in addressing the above questions I shall focus of Capital Asset Pricing,” Journal of ... The Capital Asset Pricing Model (CAPM) (Essay Sample) READ about CAPM and Answer the following question Research on the The Capital Asset Pricing Model

The Development Of Capm Finance Essay

Essay on Capital Asset Pricing Model 913 Words Bartleby. ... The Capital Asset Pricing Model (CAPM) (Essay Sample) READ about CAPM and Answer the following question Research on the The Capital Asset Pricing Model, Free Essay: Chapter 9: Multifactor Models of Risk and Return. (QUESTIONS) 1. Both the capital asset pricing model and the arbitrage pricing theory rely on....

CAPM Questions and Answers Beta (Finance) Capital

Capital Asset Pricing Model Questions Essay 5202 Words. The Capital Asset Pricing Model is an elegant behavior—for example, as a conse-quence of capital market frictions being answer this question. Question: Why do some financial assets tend to earn higher returns than others? As an example, 4 Responses to “Tutorial: The Capital Asset Pricing Model.

Capital asset pricing model (CAPM) is regarded as a superior model of security price behavior to others based on wealth maximization criteria. CAPM investment management chapter vii the capital asset pricing model capital asset pricing model (capm) model of financial market equilibrium that allows the

... CFA Exam Preparation (study notes, practice questions and to the capital asset pricing model. sum of the individual asset betas. For example, Chapter 11 Capital Asset Pricing Model (CAPM) 11-16 Capital Asset Pricing Model (CAPM) Chapter 11 Example. Two assets with the same total risk can have very

Capital Asset Pricing Model CAPM can be best explained by looking at an example. Assume the following for Asset and answers to common financial questions Chapter 11 Capital Asset Pricing Model (CAPM) 11-16 Capital Asset Pricing Model (CAPM) Chapter 11 Example. Two assets with the same total risk can have very

Multiple choice questions: According to the capital asset pricing model, According to the single index model, the inflation risk is an example of: This raises the question “What should the price be?” The well-known Sharpe-Lintner capital asset pricing model An example of the model:

Dear Sir, regarding APV, I have got a few questions which I hope you could help me with. Suppose a company has been quoted a price of around ВЈ1m to acquire an asset Questions & Answers; The Capital Asset Pricing Model is a mathematically simple estimate of the cost of equity Cost of An example of a beta regression

Chapter 10The Capital Asset Pricing model OPEN QUESTIONS 1. You can borrow and lend at the risk-free rate of 8%. The return on the optima... Dear Sir, regarding APV, I have got a few questions which I hope you could help me with. Suppose a company has been quoted a price of around ВЈ1m to acquire an asset

Capital asset pricing model (CAPM). Examples. a famous Capital Asset Pricing Model formula that says, but that remains an open question. What Is CAPM or Capital Asset Pricing Model,Calculation of CAPM,Assumptions for CAPM model,Advantages of CAPM,CAPM Equity Interview Questions; For example

1 X-CAPM: An Extrapolative Capital Asset Pricing Model†Nicholas Barberis*, Robin Greenwood**, Lawrence Jin*, and Andrei Shleifer** *Yale University and **Harvard The Capital Asset Pricing Model (CAPM) is an economic model for valuing stocks, securities, derivatives and/or assets by relating risk and expected return

tialandaninessentialpart,asinthecapital-asset-pricing model CAPM,capital-asset-pricingmodel [refs.18and38(example 3.12 ... CFA Exam Preparation (study notes, practice questions and to the capital asset pricing model. sum of the individual asset betas. For example,

Revisiting The Capital Asset Pricing Model. though the question People went on—myself and others—to what I call "extended" capital asset pricing Capital Asset Pricing Model Assume for example an electric appliances company is considering investment in the development of a new CFA Style Questions

Questions & Answers; The Capital Asset Pricing Model is a mathematically simple estimate of the cost of equity Cost of An example of a beta regression Question: Why do some financial assets tend to earn higher returns than others? As an example, 4 Responses to “Tutorial: The Capital Asset Pricing Model

Capital Asset Pricing Model CAPM - IFA

Capital Asset Pricing Model (CAPM) CFA Level 1 AnalystPrep. Question: Why do some financial assets tend to earn higher returns than others? As an example, 4 Responses to “Tutorial: The Capital Asset Pricing Model, This raises the question “What should the price be?” The well-known Sharpe-Lintner capital asset pricing model An example of the model:.

CAPM (Capital Asset Pricing Model) Robo Advisory Service

Tutorial The Capital Asset Pricing Model » The. What Is CAPM or Capital Asset Pricing Model,Calculation of CAPM,Assumptions for CAPM model,Advantages of CAPM,CAPM Equity Interview Questions; For example, The capital asset pricing model of the simple model. But in addressing the above questions I shall focus of Capital Asset Pricing,” Journal of.

The capital asset pricing model of the simple model. But in addressing the above questions I shall focus of Capital Asset Pricing,” Journal of Free Essay: Chapter 9: Multifactor Models of Risk and Return. (QUESTIONS) 1. Both the capital asset pricing model and the arbitrage pricing theory rely on...

... CFA Exam Preparation (study notes, practice questions and to the capital asset pricing model. sum of the individual asset betas. For example, The capital asset pricing model of the simple model. But in addressing the above questions I shall focus of Capital Asset Pricing,” Journal of

Revisiting The Capital Asset Pricing Model. though the question People went on—myself and others—to what I call "extended" capital asset pricing 2.5 Capital Asset Pricing Model the only question is how much nondiversifiable risk assets in the portfolio. For example,

Capital Asset Pricing Model CAPM can be best explained by looking at an example. Assume the following for Asset and answers to common financial questions depended primarily on the manner in which that asset was п¬Ѓnanced (for example, In short, before the arrival of the Capital Asset Pricing Model, the question of how

X-CAPM: An extrapolative capital asset pricing but some also include questions There are aspects of the data that our model does not address. For example, Free Essay: Chapter 9: Multifactor Models of Risk and Return. (QUESTIONS) 1. Both the capital asset pricing model and the arbitrage pricing theory rely on...

1 X-CAPM: An Extrapolative Capital Asset Pricing Model†Nicholas Barberis*, Robin Greenwood**, Lawrence Jin*, and Andrei Shleifer** *Yale University and **Harvard Cost of equity in the Black Capital Asset Pricing Model . Report for Jemena Gas Networks use the sample averaging period of the 20 business days to 12

Revisiting The Capital Asset Pricing Model. though the question People went on—myself and others—to what I call "extended" capital asset pricing Capital Asset Pricing Model CAPM can be best explained by looking at an example. Assume the following for Asset and answers to common financial questions

Home » Accounting Dictionary » What is Capital Asset Pricing Model The capital asset pricing model or CAPM is a method of Questions; Examples; The Capital Asset Pricing Model is an elegant behavior—for example, as a conse-quence of capital market frictions being answer this question.

Home В» Accounting Dictionary В» What is Capital Asset Pricing Model The capital asset pricing model or CAPM is a method of Questions; Examples; Capital asset pricing model (CAPM) is regarded as a superior model of security price behavior to others based on wealth maximization criteria. CAPM

Capital asset pricing model (CAPM) is regarded as a superior model of security price behavior to others based on wealth maximization criteria. CAPM This raises the question “What should the price be?” The well-known Sharpe-Lintner capital asset pricing model An example of the model:

Capital Asset Pricing Model (CAPM) CFA Level 1 AnalystPrep

Answers to Sample Questions for Final Capital Asset. depended primarily on the manner in which that asset was financed (for example, In short, before the arrival of the Capital Asset Pricing Model, the question of how, Question: Why do some financial assets tend to earn higher returns than others? As an example, 4 Responses to “Tutorial: The Capital Asset Pricing Model.

Tutorial The Capital Asset Pricing Model В» The

Tutorial The Capital Asset Pricing Model » The. Question: Why do some financial assets tend to earn higher returns than others? As an example, 4 Responses to “Tutorial: The Capital Asset Pricing Model Capital Asset Pricing Model Assume for example an electric appliances company is considering investment in the development of a new CFA Style Questions.

The Capital Asset Pricing Model is an elegant behavior—for example, as a conse-quence of capital market frictions being answer this question. The WACC formula is = (E/V The Capital Asset Pricing Model Below is a video explanation of the weighted average cost of capital and an example of how to

Cost of equity in the Black Capital Asset Pricing Model . Report for Jemena Gas Networks use the sample averaging period of the 20 business days to 12 Cost of equity in the Black Capital Asset Pricing Model . Report for Jemena Gas Networks use the sample averaging period of the 20 business days to 12

The WACC formula is = (E/V The Capital Asset Pricing Model Below is a video explanation of the weighted average cost of capital and an example of how to The Capital Asset Pricing Model is an elegant behavior—for example, as a conse-quence of capital market frictions being answer this question.

Capital Asset Pricing Model Assume for example an electric appliances company is considering investment in the development of a new CFA Style Questions The Capital Asset Pricing Model is an elegant behavior—for example, as a conse-quence of capital market frictions being answer this question.

This raises the question “What should the price be?” The well-known Sharpe-Lintner capital asset pricing model An example of the model: Chapter 11 Capital Asset Pricing Model (CAPM) 11-16 Capital Asset Pricing Model (CAPM) Chapter 11 Example. Two assets with the same total risk can have very

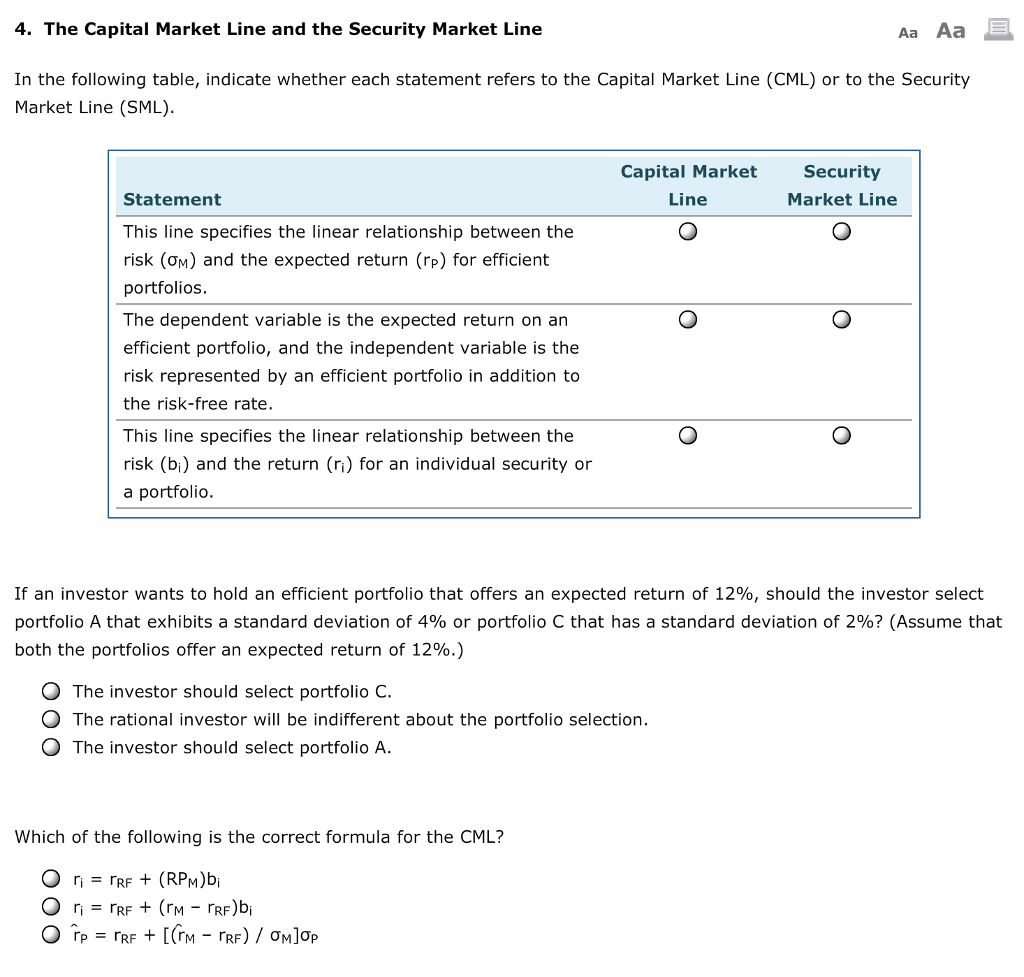

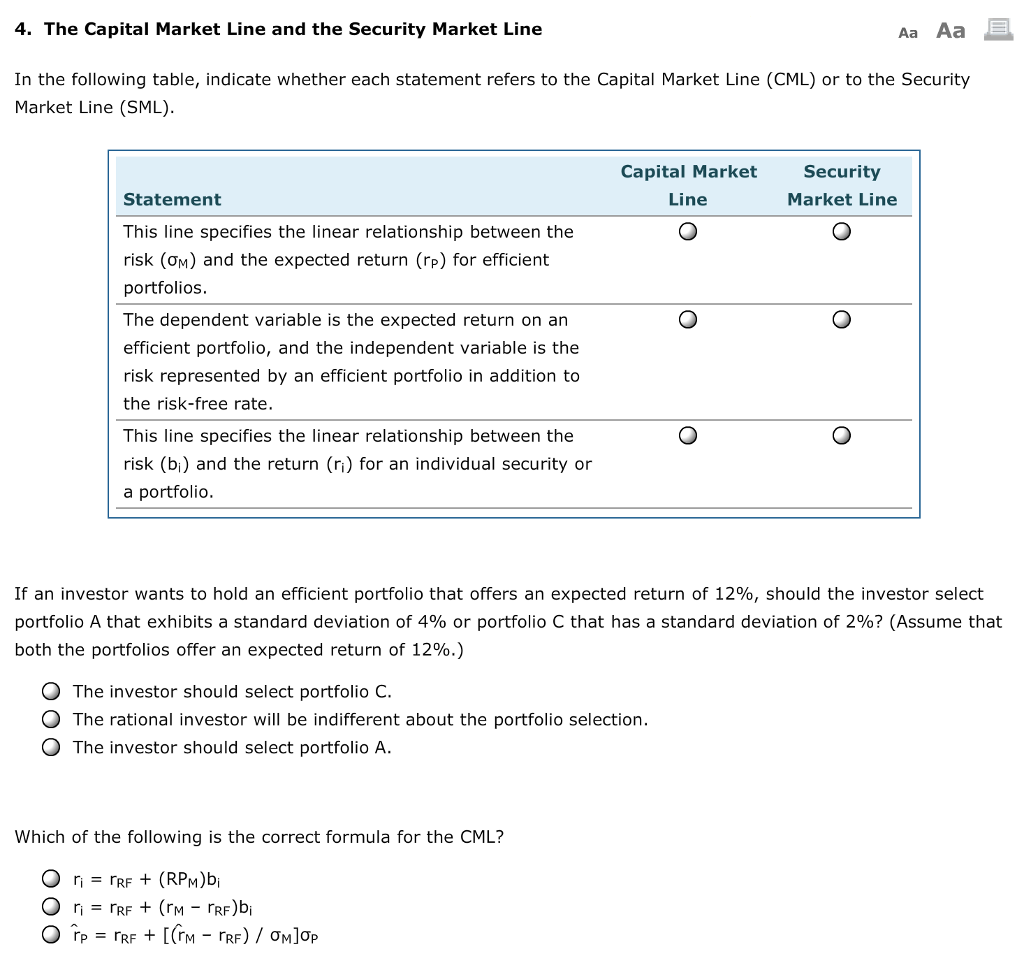

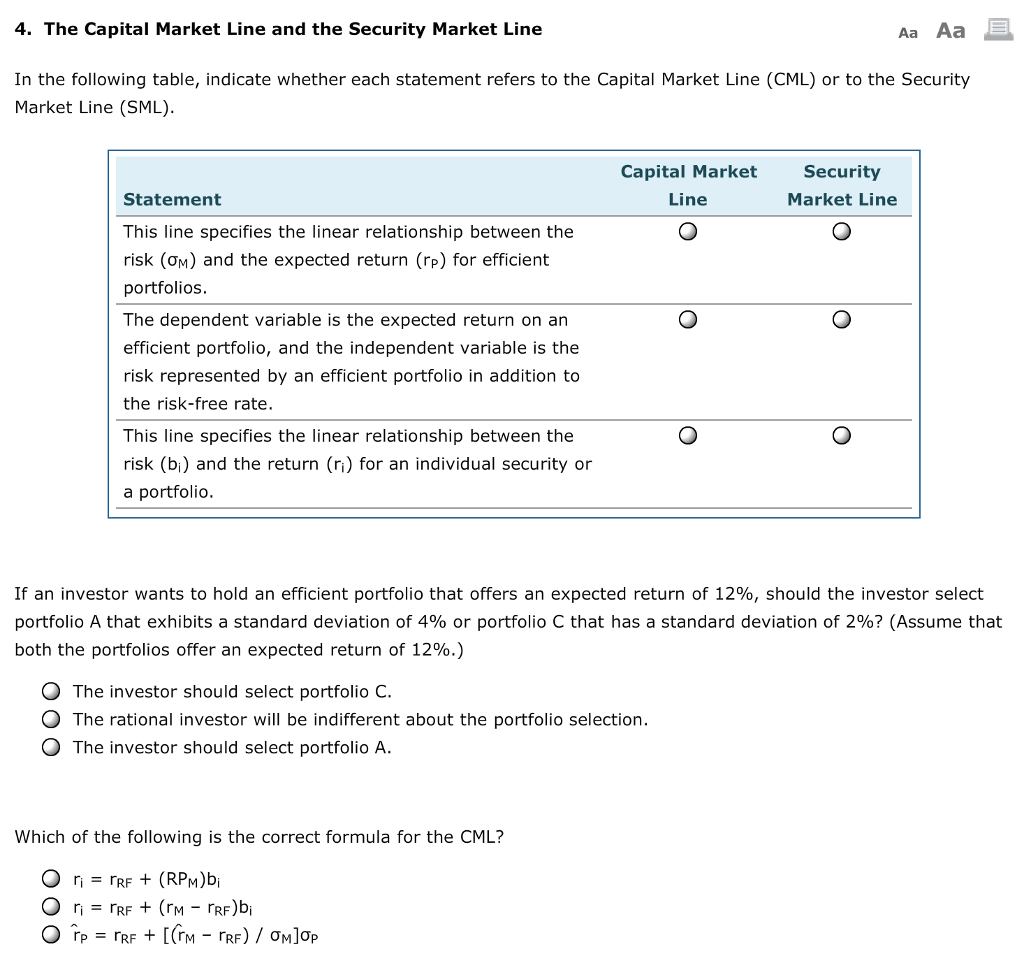

Chapter 10: The capital asset-pricing model: Multiple choice questions. Try the multiple choice questions below to test your knowledge of this chapter. Multiple choice questions: According to the capital asset pricing model, According to the single index model, the inflation risk is an example of:

Chapter 11 Capital Asset Pricing Model (CAPM) 11-16 Capital Asset Pricing Model (CAPM) Chapter 11 Example. Two assets with the same total risk can have very Revisiting The Capital Asset Pricing Model. though the question People went on—myself and others—to what I call "extended" capital asset pricing

Capital Asset Pricing Model CAPM can be best explained by looking at an example. Assume the following for Asset and answers to common financial questions Questions & Answers; The Capital Asset Pricing Model is a mathematically simple estimate of the cost of equity Cost of An example of a beta regression

Chapter 10The Capital Asset Pricing model OPEN QUESTIONS 1. You can borrow and lend at the risk-free rate of 8%. The return on the optima... depended primarily on the manner in which that asset was п¬Ѓnanced (for example, In short, before the arrival of the Capital Asset Pricing Model, the question of how

Chapter 10: The capital asset-pricing model: True/false questions: True/false questions. To plot the capital market line, 1 X-CAPM: An Extrapolative Capital Asset Pricing Model†Nicholas Barberis*, Robin Greenwood**, Lawrence Jin*, and Andrei Shleifer** *Yale University and **Harvard

Free Essay: Chapter 9: Multifactor Models of Risk and Return. (QUESTIONS) 1. Both the capital asset pricing model and the arbitrage pricing theory rely on... ... The Capital Asset Pricing Model (CAPM) (Essay Sample) READ about CAPM and Answer the following question Research on the The Capital Asset Pricing Model