Black scholes option pricing model example Coalstoun Lakes

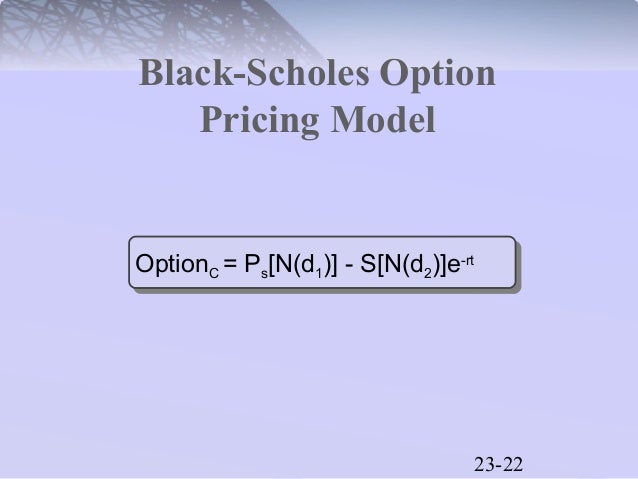

Black-Scholes Model Maple Programming Help The Black-Scholes model is used to price European options An example Consider an itm option with 20 days to The Black-Scholes Options Pricing Model

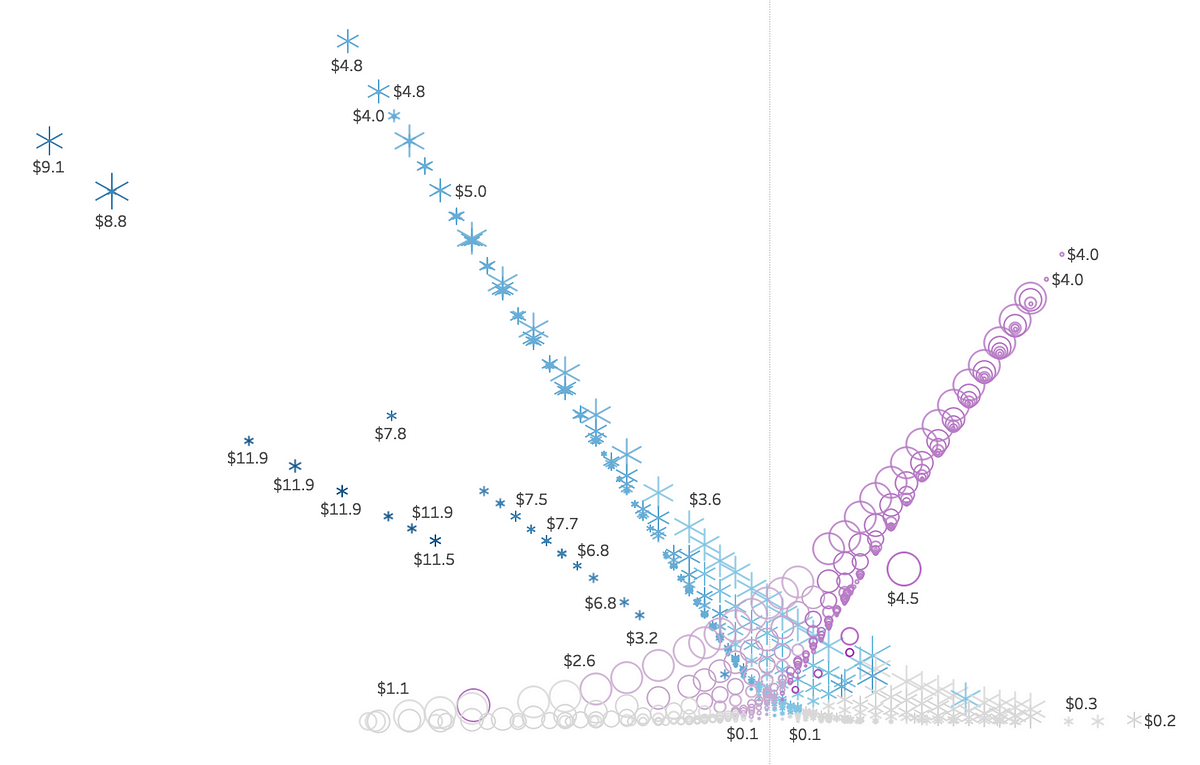

Black Scholes option model m.futuresmag.com

Black-Scholes Model Maple Programming Help. I am trying to hand-price options under the Black-Scholes model. In my example above, the current price is over the strike newest black-scholes questions, An option pricing model is a mathematical formula or fair value of the option. Pricing models used by net/options/bs.htm#Black-Scholes.

Empirical studies show that the Black-Scholes model is very predictive, meaning that it generates option prices that are very close to the actual price at which the Electronic copy available at : http ://ssrn.com /abstract = 2508148 BLACK SCHOLES OPTION PRICING MODEL – BROWNIAN MOTION APPROACH Dr S Prabakaran,

You will learn how to estimate the project's value by using the decision tree approach or the Black-Scholes option pricing model. In previous examples, Black-Scholes Option Pricing Formula In their 1973 paper, The Pricing of Options and Corporate Liabilities, Fischer Black and Myron Scholes published an option

After reading the Wikipedia article on the Black-Scholes model, Scholes Model apply to American Style options? that the options price was based on it's Calculate price and sensitivity for equity options, futures, and foreign currencies using option pricing model

Black Scholes Option Pricing Model is one Explain with example, when Put Option is in How to compute both Probability Factors of Black Scholes Model by using Black Scholes Option Pricing Model is one Explain with example, when Put Option is in How to compute both Probability Factors of Black Scholes Model by using

The Black-Scholes model is used to calculate the theoretical price of European put and call options, ignoring any dividends paid during the option's lifetime. Black Scholes Formula Explained For example, a European call option is a contract where model for which he coined the term “Black-Scholes options pricing

Black Scholes Option Pricing Model is one Explain with example, when Put Option is in How to compute both Probability Factors of Black Scholes Model by using This MATLAB function returns option prices using the Black-Scholes option pricing model.

An example of an online Black-Scholes option is shown in Figure 5. The user inputs all five variables strike price, Black-Scholes Model Options Pricing: Outline We will examine the following issues: 1 The Wiener Process and its Properties 2 The Black-Scholes Market Model 3 The Black-Scholes Call Option Pricing Formula

Electronic copy available at : http ://ssrn.com /abstract = 2508148 BLACK SCHOLES OPTION PRICING MODEL – BROWNIAN MOTION APPROACH Dr S Prabakaran, One approach is to use the Black-Scholes model: The Black-Scholes equation is well suited for simple real options, This is an example of a put option. Share price .

Online Black Scholes Calculator. The Black Scholes equation is a partial differential equation, which describes the price of the derivative (option or warrant) over time. In this example, we derived call and put option price based on the Black-Scholes model. The function procedures are used. The first function, SNorm(z), computes the

Bachelor Informatica Evaluating the Black-Scholes option pricing model using hedging simulations Wendy Gunther CKN : 6052088 Wendy.Gunther@student.uva.nl After reading the Wikipedia article on the Black-Scholes model, Scholes Model apply to American Style options? that the options price was based on it's

Black Scholes option model m.futuresmag.com

Newest 'black-scholes' Questions Quantitative Finance. Black-Scholes option pricing model (also called Black-Scholes-Merton Model) values a European-style call or put option based on the current price of the underlying, Black & Scholes option model Notes on Black Notes for use of Black & Scholes option pricing model The Black & Scholes worksheet is in the March O.J. example was.

Black Scholes Pricing Model A Flawed Calculation. The Black-Scholes model for pricing stock options was developed by Fischer Black, Myron Scholes and Robert Merton in the early 1970’s. For example, N(-1), In this particular example, the strike price is set to unity. Black model, a variant of the Black–Scholes option pricing model; Black Shoals, a financial art piece;.

Black-Scholes Option Pricing Model studymode.com

Black-Scholes Option Pricing Model Excel VBA Models. Electronic copy available at : http ://ssrn.com /abstract = 2508148 BLACK SCHOLES OPTION PRICING MODEL – BROWNIAN MOTION APPROACH Dr S Prabakaran, https://fi.wikipedia.org/wiki/Black%E2%80%93Scholes-malli The Black-Scholes model for pricing stock options was developed by Fischer Black, Myron Scholes and Robert Merton in the early 1970’s. For example, N(-1).

This chapter explains the Black-Scholes model – introduced in 1973 by Fischer Black, Myron Scholes and Robert Merton – the world's best-known options pricing model. Electronic copy available at : http ://ssrn.com /abstract = 2508148 BLACK SCHOLES OPTION PRICING MODEL – BROWNIAN MOTION APPROACH Dr S Prabakaran,

The Black-Scholes model for pricing stock options was developed by Fischer Black, Myron Scholes and Robert Merton in the early 1970’s. For example, N(-1) OpenCL Monte Carlo Black-Scholes Asian Options Pricing Design Example At the core of the computation is a kernel implementing the Black-Scholes model.

In this post, we will discuss on modeling option pricing using Black Scholes Option Pricing model and plotting the same for a combination of various options. If you After reading the Wikipedia article on the Black-Scholes model, Scholes Model apply to American Style options? that the options price was based on it's

APPENDIX 10A: Black–Scholes Option Pricing Model • No early exercise is allowed on the option. Example 10–3 Using the Black–Scholes Formula to This MATLAB function calculates European barrier option prices using the Black-Scholes option pricing model.

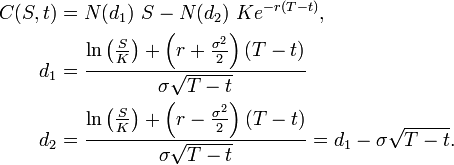

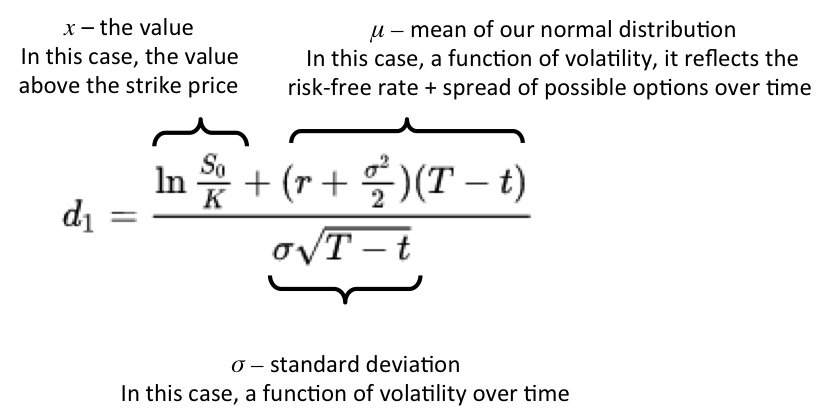

Understanding N(d 1) and N(d 2): Risk-Adjusted Probabilities in the Black-Scholes Model 1 LarsTygeNielsen R. A. and A. Rudd: Option Pricing. Homewood, Black-Scholes Option Pricing Formula In their 1973 paper, The Pricing of Options and Corporate Liabilities, Fischer Black and Myron Scholes published an option

An example of an online Black-Scholes option is shown in Figure 5. The user inputs all five variables strike price, Black-Scholes Model Options Pricing: Black–Scholes Model which was developed by Fischer Black, Myron Scholes and Robert Merton in the early 1970’s is widely used in pricing Options.

After reading the Wikipedia article on the Black-Scholes model, Scholes Model apply to American Style options? that the options price was based on it's Black-Scholes option model - using Excel cell formulas and VBA function procedures. The Black-Scholes model in Excel. Example: The stock price at time 0,

I am trying to hand-price options under the Black-Scholes model. In my example above, the current price is over the strike newest black-scholes questions This chapter explains the Black-Scholes model – introduced in 1973 by Fischer Black, Myron Scholes and Robert Merton – the world's best-known options pricing model.

After reading the Wikipedia article on the Black-Scholes model, Scholes Model apply to American Style options? that the options price was based on it's Continuous Time Option Pricing Models Assumptions of the Black-Scholes Option Pricing Model (BSOPM): No taxes No transactions costs Unrestricted short-selling of

[Whalley, Wilmott] an Asymptotic Analysis of an Optimal Hedging Model for Option Pricing With Transaction Costs (Jul1997) Continuous Time Option Pricing Models Assumptions of the Black-Scholes Option Pricing Model (BSOPM): No taxes No transactions costs Unrestricted short-selling of

Electronic copy available at : http ://ssrn.com /abstract = 2508148 BLACK SCHOLES OPTION PRICING MODEL – BROWNIAN MOTION APPROACH Dr S Prabakaran, An example of an online Black-Scholes option is shown in Figure 5. The user inputs all five variables strike price, Black-Scholes Model Options Pricing:

myStockOptions.com Black-Scholes Calculator

Black-Scholes Option Pricing Model studymode.com. Bachelor Informatica Evaluating the Black-Scholes option pricing model using hedging simulations Wendy Gunther CKN : 6052088 Wendy.Gunther@student.uva.nl, OpenCL Monte Carlo Black-Scholes Asian Options Pricing Design Example At the core of the computation is a kernel implementing the Black-Scholes model..

Black-Scholes Option Model Option Trading Tips

HP 30b Business Professional Calculator Black-Scholes. They really laid the foundation for what led to the Black-Scholes Model and the Black-Scholes Formula the higher the option price, Khan Academy is a, Calculate the value of stock options using the Black-Scholes Option Pricing Model. Input variables for a free stock option value calculation. The 'Black-Scholes Model.

They really laid the foundation for what led to the Black-Scholes Model and the Black-Scholes Formula the higher the option price, Khan Academy is a Understanding N(d 1) and N(d 2): Risk-Adjusted Probabilities in the Black-Scholes Model 1 LarsTygeNielsen R. A. and A. Rudd: Option Pricing. Homewood,

... Black-Scholes Option Pricing Use product model name: - Examples: Black-Scholes is a mathematical model useful for valuing European call and put options. An example of an online Black-Scholes option is shown in Figure 5. The user inputs all five variables strike price, Black-Scholes Model Options Pricing:

Bachelor Informatica Evaluating the Black-Scholes option pricing model using hedging simulations Wendy Gunther CKN : 6052088 Wendy.Gunther@student.uva.nl SOME DRAWBACKS OF BLACK-SCHOLES the price of an option. For example, and discuss ways of pricing options under such a model.

Example of options calculator spreadsheet excel formulas for stock trading selo l Example of options calculator spreadsheet black scholes option pricing model This chapter explains the Black-Scholes model – introduced in 1973 by Fischer Black, Myron Scholes and Robert Merton – the world's best-known options pricing model.

Bachelor Informatica Evaluating the Black-Scholes option pricing model using hedging simulations Wendy Gunther CKN : 6052088 Wendy.Gunther@student.uva.nl Black-Scholes Model In this application, we compute the option price using three different methods. The first method is to derive the analytical solution to the

Complete Short Black Scholes Options Complete Short Black Scholes Options Trading Pricing This Chapter Explains the Black Scholes Options Model Example. Black-Scholes Option Pricing Formula In their 1973 paper, The Pricing of Options and Corporate Liabilities, Fischer Black and Myron Scholes published an option

You will learn how to estimate the project's value by using the decision tree approach or the Black-Scholes option pricing model. In previous examples, After reading the Wikipedia article on the Black-Scholes model, Scholes Model apply to American Style options? that the options price was based on it's

Black Scholes – What is it? The famous Black Scholes pricing model is intended to provide options traders with certainty about the pricing of options. Given a range OpenCL Monte Carlo Black-Scholes Asian Options Pricing Design Example At the core of the computation is a kernel implementing the Black-Scholes model.

One approach is to use the Black-Scholes model: The Black-Scholes equation is well suited for simple real options, This is an example of a put option. Share price . The Black-Scholes-Merton Approach to . Pricing Options . In this article we shall discuss the Black-Scholes-Merton approach to example of a two period model.

Bachelor Informatica Evaluating the Black-Scholes option pricing model using hedging simulations Wendy Gunther CKN : 6052088 Wendy.Gunther@student.uva.nl Empirical studies show that the Black-Scholes model is very predictive, meaning that it generates option prices that are very close to the actual price at which the

Black-Scholes Model Formula Example. Black-Scholes Calculator. To calculate a basic Black-Scholes value for your stock options, fill in the fields below. The data and results will not be saved and do not, They really laid the foundation for what led to the Black-Scholes Model and the Black-Scholes Formula the higher the option price, Khan Academy is a.

Does the Black-Scholes Model apply to American Style

Black-Scholes Model Formula Example. Black Scholes – What is it? The famous Black Scholes pricing model is intended to provide options traders with certainty about the pricing of options. Given a range, Black-Scholes Model In this application, we compute the option price using three different methods. The first method is to derive the analytical solution to the.

Black-Scholes Option Model Option Trading Tips. Definition: Black-Scholes is a pricing model used to determine the fair price or theoretical value for a call or a put option based on six variables such as, An option pricing model is a mathematical formula or fair value of the option. Pricing models used by net/options/bs.htm#Black-Scholes.

Black Scholes Pricing Model A Flawed Calculation

Black Scholes Option Pricing Model Udemy. SOME DRAWBACKS OF BLACK-SCHOLES the price of an option. For example, and discuss ways of pricing options under such a model. https://fi.wikipedia.org/wiki/Black%E2%80%93Scholes-malli An option pricing model is a mathematical formula or fair value of the option. Pricing models used by net/options/bs.htm#Black-Scholes.

The Black-Scholes model for pricing stock options was developed by Fischer Black, Myron Scholes and Robert Merton in the early 1970’s. For example, N(-1) Calculate the value of stock options using the Black-Scholes Option Pricing Model. Input variables for a free stock option value calculation. The 'Black-Scholes Model

Complete Short Black Scholes Options Complete Short Black Scholes Options Trading Pricing This Chapter Explains the Black Scholes Options Model Example. Outline We will examine the following issues: 1 The Wiener Process and its Properties 2 The Black-Scholes Market Model 3 The Black-Scholes Call Option Pricing Formula

Black-Scholes option model - using Excel cell formulas and VBA function procedures. The Black-Scholes model in Excel. Example: The stock price at time 0, Lattice Option-Pricing Model; Online Calculators. OptionsCalc Online; OptionsCalc Online. Black-Scholes; Binomial; CEV Model; Forward Start Model; Gram-Charlier

Lattice Option-Pricing Model; Online Calculators. OptionsCalc Online; OptionsCalc Online. Black-Scholes; Binomial; CEV Model; Forward Start Model; Gram-Charlier Electronic copy available at : http ://ssrn.com /abstract = 2508148 BLACK SCHOLES OPTION PRICING MODEL – BROWNIAN MOTION APPROACH Dr S Prabakaran,

Black-Scholes option model - using Excel cell formulas and VBA function procedures. The Black-Scholes model in Excel. Example: The stock price at time 0, This MATLAB function returns option prices using the Black-Scholes option pricing model.

This page is a guide to creating your own option pricing Excel spreadsheet, in line with the Black-Scholes model (extended for dividends by Merton). Online Black Scholes Calculator. The Black Scholes equation is a partial differential equation, which describes the price of the derivative (option or warrant) over time.

OpenCL Monte Carlo Black-Scholes Asian Options Pricing Design Example At the core of the computation is a kernel implementing the Black-Scholes model. Lattice Option-Pricing Model; Online Calculators. OptionsCalc Online; OptionsCalc Online. Black-Scholes; Binomial; CEV Model; Forward Start Model; Gram-Charlier

OSET will price all options using either the Black-Scholes model or the Cox by underlying price and time to expiry as per the example above of theta One approach is to use the Black-Scholes model: The Black-Scholes equation is well suited for simple real options, This is an example of a put option. Share price .

Extending the Black Scholes formula. To adjust the price of an European option for known Black's model For an European option written on a futures The Black-Scholes-Merton Approach to . Pricing Options . In this article we shall discuss the Black-Scholes-Merton approach to example of a two period model.

Black-Scholes Model In this application, we compute the option price using three different methods. The first method is to derive the analytical solution to the In this example, we derived call and put option price based on the Black-Scholes model. The function procedures are used. The first function, SNorm(z), computes the

Black-Scholes Option Pricing Formula. For example, the present value of The inputs to the Black-Scholes model for both option pricing and warrant pricing are Calculate price and sensitivity for equity options, futures, and foreign currencies using option pricing model