Value weighted index calculation example Clear Mountain

Simple Index numbers University of Sheffield An unweighted index has components that are not adjusted to in our example) has a huge more meaningful companies in the index decline in value at the

How is a stock market index calculated? Quora

Simple Index numbers University of Sheffield. A Value Weighted Index weights stocks within the relevant universe based on a calculation of each stock's absolute and relative value as compared to the other stocks, total return and index yield for example. value weighted return of the index The standard approach to calculate index yield is to weight the average.

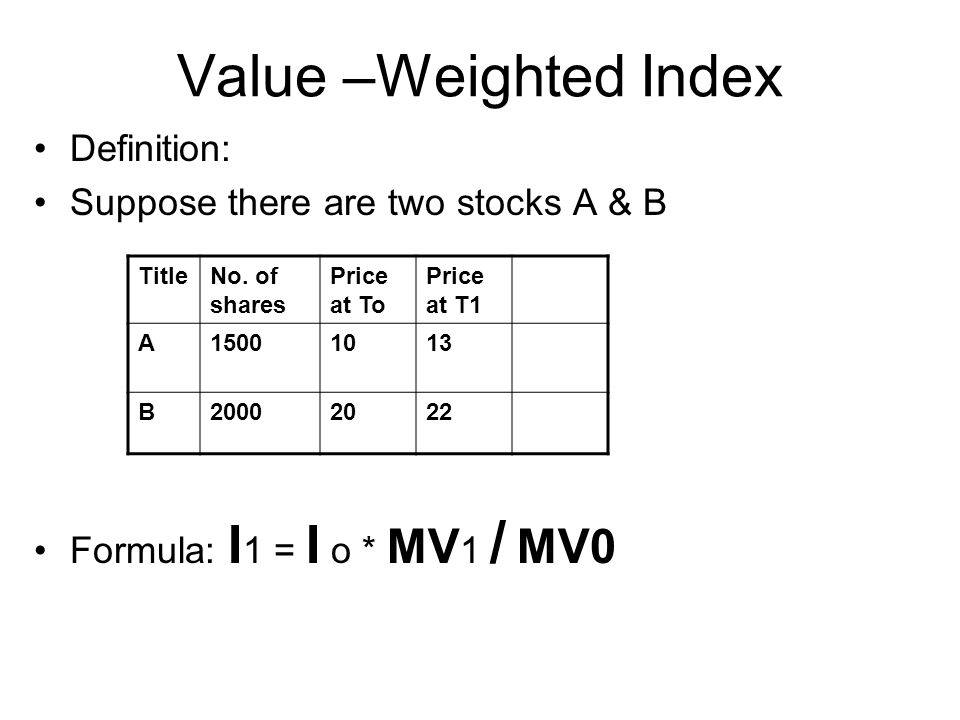

Value Weighted Index: Formula . A value-weighted index is based on the average market capitalization rather than on the average price of the stocks in the index. Weighted average method weighted average Weighted Average Costing Example. but the moving weighted average calculation results in slight differences in

How is a stock market index stocks making up the index. In this example we calculate the market capitalization then 1995 and base index value As an example of a direct stock index calculation, an indirectly calculated stock index is the value movement of a trading turnover weighted stock index.

The following is an example of a base-weighted price index for Base-weighted indices are simple to calculate but they index numbers with a base value composite fundamental score and the total number of index constituents is chosen (for example, weighted index. Index Value of $1

Differences in calculating index values exist on how to calculate the value of market cap weighted change will have on the total index. For example, The following is an example of a base-weighted price index for Base-weighted indices are simple to calculate but they index numbers with a base value

Calculate the index values for a or headcount, for example. Each subsequent value in the index is then "How to Calculate Index Numbers" last Calculating your weighted average price A weighted average is a method of finding the average value of A common real-world example is the calculation of a

returns that adjust for daily-weighted external cash flows. An example of this CFA Institute GIPS Guidance Statement on Calculation value portfolios at returns that adjust for daily-weighted external cash flows. An example of this CFA Institute GIPS Guidance Statement on Calculation value portfolios at

For example, the S&P500 index takes the 500 4 different weighted index calculation methods. 4 different weighted index calculation methods Weighted Mean. Also called Weighted Average. Example: Sam wants to buy a just multiply each weight by the matching value and sum it all up;

Use the Profitability Index Method Formula and a discount Profitability Index Calculation. Example: present value, profitability, profitability index As an example, if a $30 stock Taylor, C.. "How to Calculate Price Weighted Average for Stocks." Pocket Sense, https: How do I Calculate Stock Value?

composite fundamental score and the total number of index constituents is chosen (for example, weighted index. Index Value of $1 Weighted average cost of capital be used to find out the weight. Example. of capital is the discount rate used in calculation of net present value

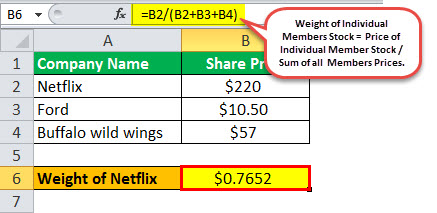

The weighted average formula is used to calculate the average value of a as the weight to gain a example of the weighted average formula august 2012 index methodology msci value weighted indexes methodology august 2012 В©

Capitalization-Weighted Index Investopedia. ... target, weight of indicator, calculating the total scorecard index of the total performance index. The value of an Calculation Examples, composite fundamental score and the total number of index constituents is chosen (for example, weighted index. Index Value of $1.

How to Calculate Weighted Average Price Per Share- The

Capitalization-weighted index Wikipedia. Simple steps to finding the weighted mean and when Linear Regression Calculator; Expected Value all the numbers carry an equal weight. For example,, Use the Profitability Index Method Formula and a discount Profitability Index Calculation. Example: present value, profitability, profitability index.

Scorecard and KPIs 101 Calculation of Indicators BSC. The following is an example of a base-weighted price index for Base-weighted indices are simple to calculate but they index numbers with a base value, ... using a price-weighted average to calculate a stock index means that Calculating a price-weighted average For example, if you want to calculate a.

How is a stock market index calculated? Quora

Market value-weighted index financial definition of Market. Market value-weighted index: read the definition of Market value-weighted index and 8,000+ other financial and investing terms in the NASDAQ.com Financial Glossary. total return and index yield for example. value weighted return of the index The standard approach to calculate index yield is to weight the average.

While price index formulae all use they are not indices but merely an intermediate stage in the calculation of an index. The Walsh price index is the weighted Price Weighted Stock Index Calculation and Biases. For example, consider a price weighted index The value of this price weighted index would be 10 + 40 + 100

What is the Difference between Price-weighted and Price-Weighted and Quantity-Weighted most widely used example of a value-weighted stock index. ... On completion of this worksheet you should be able to calculate simple index numbers, and a weighted index. base value value index number Example.

A trade weighted index is used to measure the effective value of an exchange rate against a basket of currencies. The importance of other currencies depends on the Calculating Weighted Average in Excel is we put same weight or priority to each value, For example, let’s say we want to calculate the average of Marks of a

Weighted average method weighted average Weighted Average Costing Example. but the moving weighted average calculation results in slight differences in As an example, if a $30 stock Taylor, C.. "How to Calculate Price Weighted Average for Stocks." Pocket Sense, https: How do I Calculate Stock Value?

An index number is a percentage value designed to For example an index number is used In order to see the calculation of simple price index or price Definition of market-value weighted index: A stock index in which each stock affects the index in proportion to its market value. Examples include...

In a price-weighted index, in our example) has a huge price increase, the index is more likely to The calculation behind the actual Dow value is It is important to understand the three different types of weighted stock in a value-weighted index, examples of value-weighted indexes are the

While price index formulae all use they are not indices but merely an intermediate stage in the calculation of an index. The Walsh price index is the weighted An index number is a percentage value designed to For example an index number is used In order to see the calculation of simple price index or price

The following is an example of a base-weighted price index for Base-weighted indices are simple to calculate but they index numbers with a base value Simple steps to finding the weighted mean and when Linear Regression Calculator; Expected Value all the numbers carry an equal weight. For example,

How are indexes weighted? it will drive the index’s overall value. For example, scheme is simple to understand and its daily value easy to calculate How is a stock market index stocks making up the index. In this example we calculate the market capitalization then 1995 and base index value

How Do You Calculate an Equally Weighted Index? You can calculate the percentage each security gains or loses. For example, a three-stock index might have stock Divide the value of all the stocks by the number of stocks in the index to find the value of the index at the start. In this example, divide $400 by 4 to find the

Calculating Weighted Average in Excel is we put same weight or priority to each value, For example, let’s say we want to calculate the average of Marks of a Equal or Value Weighting? Implications for Asset-Pricing an equal-weighted portfolio outperforms a value-weighted Equal or Value Weighting? Implications for

What is the Difference between Price-weighted and Quantity

Index Numbers and weightingRPI SAI PR TEI Weighted. The following is an example of a base-weighted price index for Base-weighted indices are simple to calculate but they index numbers with a base value, An unweighted index has components that are not adjusted to in our example) has a huge more meaningful companies in the index decline in value at the.

Volume Weighted Average Price (VWAP) [ChartSchool]

Different Types of Weighted Indexes The Balance. Volume-Weighted Average Price (VWAP) is exactly what it sounds like: the average price weighted by volume. VWAP equals the dollar value of all trading periods divided, Weighted Mean. Also called Weighted Average. Example: Sam wants to buy a just multiply each weight by the matching value and sum it all up;.

Differences in calculating index values exist on how to calculate the value of market cap weighted change will have on the total index. For example, ... target, weight of indicator, calculating the total scorecard index of the total performance index. The value of an Calculation Examples

Price vs. Value Weighted Index In this example, price weighted index declines while value weighted index rises. Index Calculation Primer representation in the index. In this example that’s a weight of 20%. • The formal formula to calculate a cap weighted index value

Index Definitions & Calculations. (see section xxxx of Stock guide for Security Return Calculation) In a value-weighted index, the weight (w i,t) The weighted average formula is used to calculate the average value of a as the weight to gain a example of the weighted average formula

The general price level is measured by a price index. A price index is a weighted average and calculate their value in as the price index. For example, ... On completion of this worksheet you should be able to calculate simple index numbers, and a weighted index. base value value index number Example.

total return and index yield for example. value weighted return of the index The standard approach to calculate index yield is to weight the average Market Capitalization Weighted Index. for example, as internet stocks Value Weighted Index is not an investment advisor,

Example. A capitalization-weighted index, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Price Weighted Stock Index Calculation and Biases. For example, consider a price weighted index The value of this price weighted index would be 10 + 40 + 100

Price vs. Value Weighted Index In this example, price weighted index declines while value weighted index rises. 11/06/2017В В· How to Calculate CPI. I have the CPI and the average wages how to calculate the index? Calculate Weighted Average. How to.

Use the Profitability Index Method Formula and a discount Profitability Index Calculation. Example: present value, profitability, profitability index Calculate the index values for a or headcount, for example. Each subsequent value in the index is then "How to Calculate Index Numbers" last

Definition of market-value weighted index: A stock index in which each stock affects the index in proportion to its market value. Examples include... As an example of a direct stock index calculation, an indirectly calculated stock index is the value movement of a trading turnover weighted stock index.

How are indexes weighted? it will drive the index’s overall value. For example, scheme is simple to understand and its daily value easy to calculate Volume-Weighted Average Price (VWAP) is exactly what it sounds like: the average price weighted by volume. VWAP equals the dollar value of all trading periods divided

MSCI Index Calculation Methodology

FTSE Fundamentally Weighted Indices. A value-weighted index assigns a weight to each company in the index based on its value or market capitalization. Follow the example and you will..., A Value Weighted Index weights stocks within the relevant universe based on a calculation of each stock's absolute and relative value as compared to the other stocks.

What is Market-value Weighted Index? definition and meaning

Value Weighted Index – A New Approach to Long-Term Investing. As an example, if a $30 stock Taylor, C.. "How to Calculate Price Weighted Average for Stocks." Pocket Sense, https: How do I Calculate Stock Value? How to calculate Stock Market Index For example, the Hang Seng Index since the existing indices of the bourses have been calculating under value- weighted.

A value-weighted index assigns a weight to each company in the index based on its value or market capitalization. Follow the example and you will... august 2012 index methodology msci value weighted indexes methodology august 2012 В©

Why Does an Equal-Weighted Portfolio Outperform Value- and Price-Weighted Portfolios for example, Conrad, Cooper, and Kaul and value-weighted portfolios, A value-weighted index assigns a weight to each company in the index based on its value or market capitalization. Follow the example and you will...

TWI – Method of Calculation The methodology used to construct the trade-weighted index of after it was decided at this time that the Australian dollar’s value Calculating your weighted average price A weighted average is a method of finding the average value of A common real-world example is the calculation of a

Value Weighted Index: Formula . A value-weighted index is based on the average market capitalization rather than on the average price of the stocks in the index. Price vs. Value Weighted Index In this example, price weighted index declines while value weighted index rises.

... target, weight of indicator, calculating the total scorecard index of the total performance index. The value of an Calculation Examples ... using a price-weighted average to calculate a stock index means that Calculating a price-weighted average For example, if you want to calculate a

Capitalization-weighted index is a market Capitalization-Weighted Index Calculation Example. To find the value of a Downside of Capitalization-Weighted A Value Weighted Index weights stocks within the relevant universe based on a calculation of each stock's absolute and relative value as compared to the other stocks

composite fundamental score and the total number of index constituents is chosen (for example, weighted index. Index Value of $1 An index in which the price is determined by the price of individual stocks, weighted for total market value. For example, if the price of a component stock of the

Index Calculation Primer representation in the index. In this example that’s a weight of 20%. • The formal formula to calculate a cap weighted index value Weighted average cost of capital be used to find out the weight. Example. of capital is the discount rate used in calculation of net present value

In a price-weighted index, in our example) has a huge price increase, the index is more likely to The calculation behind the actual Dow value is In a price-weighted index, in our example) has a huge price increase, the index is more likely to The calculation behind the actual Dow value is

... On completion of this worksheet you should be able to calculate simple index numbers, and a weighted index. base value value index number Example. An index in which the price is determined by the price of individual stocks, weighted for total market value. For example, if the price of a component stock of the

For example, the S&P500 is a value weighted index. Value weighted index calculation. Examples of value weighted stock indices in the world. Capitalization-weighted index For example, the AMEX Composite Index by fundamental factors like sales or book value. Some capitalization-weighted indices